Oh, and sorry in advance to Michael:

Headline writers, if u find yourself typing ‘It’s a Perfect Storm…’ on top of a story about market risks, please hit backspace & try again

— Michael P. Regan (@Reganonymous) September 5, 2017

Just in case you didn’t get the memo, Tuesday is shaping up to be quite the debacle for the “reflation is still alive†camp.

As noted earlier, equity weakness accelerated around lunchtime (almost on the dot) in tandem with a notable leg up for the VIX.

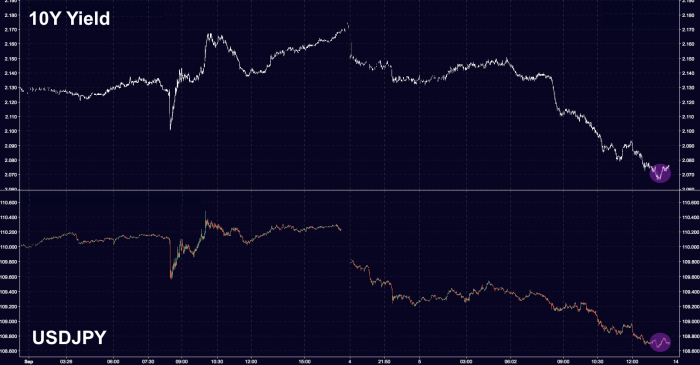

But the real story here is probably the 10Y, yields on which breached 2.07 (down ~7.5 bps from early in the U.S. session) a few minutes ago. Needless to say, that undercut USDJPY, which is trading near a fresh session low at 108.65:

There’s a confluence of factors at play here including Hurricane Irma, Hurricane Brainard (dovish this morning), legislative gridlock that’s likely to be more acute after the DACA decision, and speculation that another provocation from North Korea could come at any time.

Meanwhile, a truly terrible, tailing 4-week bill auction just sent yields on October 5 and October 12 maturities spiking 4bps. Put differently: folks are scared they aren’t going to get paid on time thanks to recalcitrant (and incompetent) lawmakers dithering in the face of a technical U.S. default.