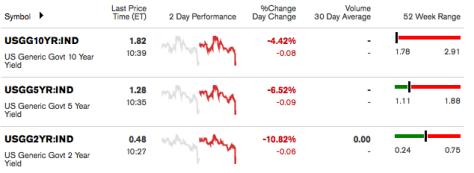

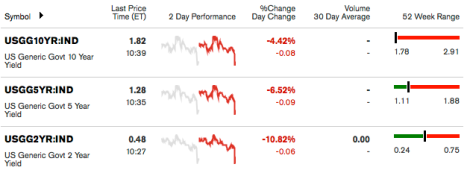

he 10 to 5 to 2 year spread is indicative of market upset, obviously.

10, 5 & 2 year yields from Bloomberg

Here is the up to the minute view of 30 year vs. 5 year yields, with a nose diving inflation expectations barometer in the lower panel. A rising yield curve can be indicative of inflation expectations rising if long-term yields are rising faster than short-term yields. Or it can be indicative of deflation fears rising if short-term yields are dropping faster.

US Retail sales figures are the latest issue. Before that it was a leveling of manufacturing (note: ISM new orders) and disappointment in hourly wages within the employment report.

Of importance will be the forward looking stuff like the aforementioned manufacturing data and the Semiconductor Book-to-Bill for December. Of course, gold vs. commodities has been telling us for months now to expect a phase of global economic contraction to some degree.

Meanwhile, most US indexes are clinging to support. Here is one that is losing support…