Introduction

A year back, whenever Xinyuan (XIN) released new quarterly reports, numerous interpretative pieces were written on the company. Earlier this month, XIN released its 1st half of 2015 numbers. Silence. Maybe those earlier interested in XIN because of its low P/E ratio and high dividend have had their questions answered. Perhaps it is because weaker Chinese economic growth and recent stock market collapse has made XIN too risky for investors. However, this latest economic news from XIN is interesting and positive.

A Quick Refresher

Before looking at the new numbers, I quote from a piece written just after XIN released its 2014 end-of -year results:

“We have all heard the positive-sounding news: fourth quarter revenues of US$362 million, a 121% increase from third quarter of 2014; contract sales of $402 million, which is a 140% increase from the third quarter of 2014. These numbers are really a testimony to just how bad the Chinese real estate market was in early 2014.â€

The Latest Numbers

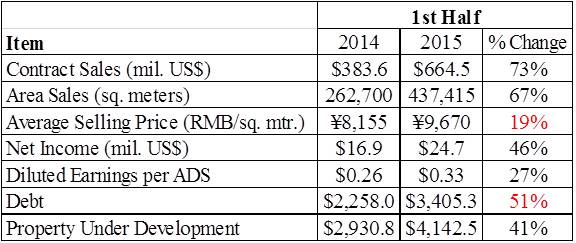

Table 1 summarizes the most important data from XIN’s 2nd quarter report. Sales, income and property under development are all up in comparison to the first half of last year. This is all very good news, particularly against reports of economic slowdown in China. It attests to the fact that XIN sells its properties to individuals who have adequate assets to buy even in a slowdown. There is further good news: XIN reports that SG&A expenses (including the lease of a company plane) have declined by 19% from the second quarter of 2014.

Table 1. – XIN Financials First Half, 2014-15

Source:Â XIN Press Release

Selling Prices

The information on selling prices demands a bit more scrutiny. An increased of 19% certainly sounds good. Table 2 provides the history of what has happened to selling prices since the second quarter of 2014. And while it is true that overall, the average price has increased since that date, the prices of a number of properties have fallen since the last quarter. The properties in red have been sold at higher prices in earlier quarters. The good news is that they constitute only 16% of the unsold properties.