US equity futures have hit a new records, helped by surging Asian and European stocks which have all started November on a euphoric note. Surging commodity prices, optimism about tax reform and hope for a new dovish Fed chair all combined to drive global stock markets to record highs on Wednesday, with the MSCI’s world stock index climbing 0.3% to a fresh all time high. Mining stocks lead gains as nickel and other industrial metals soar. Oil rose above $55 a barrel for the first time since the start of the year in the longest winning streak in three months, on hopes that major producers would maintain their output cuts. The dollar firmed ahead of a Fed rate decision while bitcoin surged to a record high just under $6,600.

As Bloomberg summarizes in its Macro Squawk Wrap, equities globally extended gains as investors await Fed developments, with a rate decision due today and announcement of the next chair expected on Thursday. Euro Stoxx 50 futures advance for a third-straight day, while S&P 500 futures set fresh day highs in the European session. Treasury futures trade in tight ranges after earlier weakening; block trades emerge, consistent with selling of U.S. bonds and buying of German debt. U.K. Oct. manufacturing PMI beats estimates, buoying sterling and sending GBP/USD above 1.3300 for the first time in weeks. WTI futures climb above $55/bbl to hit highest level since January; base metals gain broadly as nickel futures trade limit up in Shanghai.

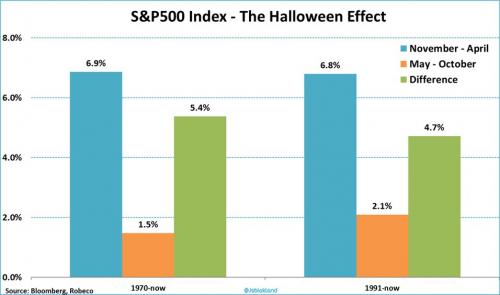

Among the proposed explanations for today’s melt up is that we are witnessing a compressed and accelerated version of the Halloween rally, as summarized in the following Robeco chart:

Whatever the reason, the buying today is unstoppable, with the European STOXX 600 index climbing to its highest level since August 2015 as stock markets in London, Paris and Frankfurt gained 0.5 to 1.2 percent in early trade. As a result, the Stoxx 600’s relative strength index has now climbed above 70, a level that indicates overbought conditions, for the first time in more than 2 weeks, and is heading for its highest level since Aug. 2015, led by cyclical sectors including miners, automakers and technology.

Europe’s jump followed a rally in Asia, where stock markets hit 10-year highs, with most of the 19 industry sectors rising. As of Tuesday’s close, 45 percent of MSCI Europe companies had reported results for the third quarter, of which 66 percent either beat or met expectations, according to Thomson Reuters I/B/E/S data.The U.K.’s FTSE 100 Index rose 0.3 percent to the highest in a week.Germany’s DAX Index increased 1.3 percent to the highest on record. DAX outperforms as German participants return to market from Reformation Day

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.9%, led by a 1.3% jump in South Korea. South Korea’s economic growth accelerated to its fastest pace in seven years last quarter. Growth in Taiwan during the same period was the strongest in 2 1/2 years.Of note in Asia was Japan, where the stock meltup was most pronounced with the Nikkei rising nearly 2%, and the Topix index rising to the highest in more than a decade, buoyed by a weaker yen, as a surge in U.S. consumer confidence in October served as the latest confirmation of a global economic recovery ahead of a Federal Reserve policy decision on Wednesday. Electronics makers gave the biggest boost to the Topix as Sony jumped 11% to the highest level since June 2008 after lifting its annual operating profit outlook to a record, after the company announced record annual profit in 2017 owing to strong sales of semiconductors and favorable exchange rates. Tokyo Electron surged after posting results that beat expectations. The Nikkei 225 gained 5.5% in October, its strongest showing in 11 months. “Investors are gaining confidence as the global economy is solid,†said Masaaki Yamaguchi, an equity market strategist at Nomura Holdings Inc. in Tokyo. “Not only exporters but also domestic-demand-oriented companies are improving earnings.†“Business confidence and corporate earnings are good in the U.S., and business sentiment is improving globally,†said Mitsushige Akino, an executive officer with Ichiyoshi Asset Management Co. in Tokyo. “Stocks are inclined to rebound, with a series of good earnings results. There’s more room for high-tech related shares to rise.â€Â

India’s benchmark equity indexes climbed to fresh records after a World Bank report showed it’s easier to do business in the nation. The S&P BSE Sensex rose 1.2% to 33,600.27 while the NSE Nifty 50 Index jumped 1% in Mumbai. Twelve of the 19 sectoral sub-indexes compiled by BSE Ltd. climbed, led by a gauge of telecom companies. Bharti Airtel Ltd. gained the most on the Sensex after the country’s largest wireless carrier said “reputed global investors†had expressed interest in buying a stake in its Bharti Infratel unit.

The dollar and Treasuries held steady ahead of a Federal Reserve decision expected to signal a rate rise is still in the cards for December. The New Zealand dollar surged after the country’s unemployment rate fell, while the yen led losses on reports Japan may plan for an increased budget and reappoint Bank of Japan Governor Haruhiko Kuroda. European stocks jumped to a two-year high. The dollar’s index against a basket of six major currencies stood at 94.60, down from last week’s three-month peak of 95.15. The euro was little changed at $1.1644, some distance from the three-month low of $1.1574 it touched on Friday after the European Central Bank’s stance was perceived to be more dovish than expected. The biggest currency mover was the New Zealand dollar. It jumped over 1 percent to $0.6931 after the country’s jobless rate sank more than expected to a nine-year low of 4.6 percent. Bitcoin hit another record high above 6,600, boosted by bets the crypto-currency might enter the financial mainstream after the world’s largest derivatives exchange operator said on Tuesday it would launch bitcoin futures. The yield on 10-year TSY rose 1bp to 2.39%. Germany’s 10-year yield also climbed 1 bp to 0.37% while Britain’s 10-year yield rose less than one basis point to 1.335%.

The Bloomberg Commodity Index climbed to the highest since March as WTI crude rose above $55 a barrel and industrial metals advanced, buoyed by optimism that demand from China won’t falter after a gauge of Chinese manufacturing suggested growth momentum remains robust. Nickel has been on a tear since Tuesday after Trafigura joined Glencore in revealing bullish forecasts because of the popularity of electric cars. Nickel sulphate is a key ingredient in lithium-ion batteries.

Â

Meanwhile, in the US, Wall Street’s three main indexes, the Dow, S&P and Naz, ended October with their biggest monthly gains since February. The focus remains firmly on central banks. In the U.S., the Federal Reserve is expected to keep rates on hold Wednesday while signaling an all-clear for a December hike. An announcement on who will helm the U.S. central bank is due by the end of the week, with current board member Jerome Powell said to have the edge over the likely more hawkish John Taylor. The Bank of England will probably lift borrowing costs on Thursday for the first time in a decade.

One potential threat to the markets’ risk-on mood could come from the unfolding investigation into whether the Trump campaign colluded with Russian interests after the first indictments from Special Counsel Robert Mueller. Former Trump adviser George Papadopoulos claimed campaign officials approved a pre-election meeting with Russian representatives. US House Tax Committee Chairman Brady said that after consultation with President Trump and leadership team, they have decided to post pone the tax plan release to Thursday. There were initial reports that GOP tax plan would delay repeal of estate tax and will have corporate taxes cut to 20% during the 1st year, according to sources. (WSJ) However, there were later conflicting reports that stated some House GOP Representatives were said to consider phasing out 20% corp. tax over a number of years