After yesterday’s violent gap up in stocks across the globe in response to the “expected” outcome from the French election, today the risk on sentiment has continued if to a lesser extent, with stocks in Europe, Asia all rising while S&P futures point to a higher open. Yen, gold decline, while the euro traded as high as 1.09 this morning before fading some gains; oil is up modestly.

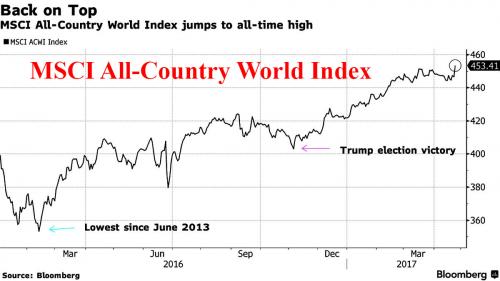

While today’s surge may have been more muted, world stocks hit a new record high on Tuesday, with investors still cheering Macron’s victory in the first round of the French presidential election, supported by speculation about U.S. tax reform and the overnight report that Trump has conceded on the border wall, eliminating a government shutdown as a potential risk. As shown below, the MSCI All World Index has jumped to a new all time high, boosted by strong Asian markets.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6%, hovering near its highest level since June 2015 hit earlier in the session, on its fourth straight day of gains. Japan’s Nikkei rose more than 1 percent to a three-week high aided by a weaker yen. South Korea’s also advanced 0.7 percent to its highest level since April 2015. China equities climbed from a three-month low on speculation that a selloff over concerns of a regulatory crackdown were overdone. Australia and New Zealand were closed for Anzac Day.

European stocks hovered near a 20-month high, with the DAX flirting with all time highs. The Stoxx Europe 600 index edged 0.2% higher after jumping 2.1% on Monday to the highest since August 2015, with property and technology shares helping to underpin a global rally. French shares pulled back 0.1 percent, having risen 4.1 percent on Monday in their biggest daily gain since August 2012. Futures on the S&P 500 added 0.1 percent. The index climbed 1.1% Monday to within 1% of its all-time closing high.

These gains helped push MSCI’s world stocks index to a fresh all-time high after chalking up its biggest rise since shortly after Britain’s vote last June to leave the European Union.

So with attention to France fading, if only until the runoff round in the election, “attention will fast move over to Washington with the outline of the Trump tax plan likely tomorrow, the need to avoid the shutdown on Friday and the end of the first 100 days of Trump on Saturday” with the White House determined that higher growth can offset tax cuts, DB’s Jim Reid wrote in his overnight note.Â

Commerzbank currency strategist Thu Lan Nguyen in Frankfurt, however, said that “(the second round) is going to be a non-event for the market. Markets have pretty much priced out the risk of a Le Pen victory, and rightly so, because the first round of the elections has shown that the polls in France were correct…and this increases the confidence in the polls for the second round…It’s highly likely that (Macron) is going to win.”

With one of the year’s major risks to markets seen less acute, markets were also looking ahead to other factors, including U.S. President Donald Trump’s promise to announce on Wednesday “a big tax reform and tax reduction”. The Wall Street Journal reported Trump wanted to cut the corporate tax rate to 15 percent. The White House budget director told Fox News on Monday Trump’s announcement would focus on principles, ideas and rates. “I’m becoming little concerned over the President’s big announcements, especially since we haven’t seen any major legislative achievement so far and he will be marking his 100th day in the White House this Saturday,” said FXTM chief market strategist Hussein Sayed in a note.

Elsewhere, the ECB said in a quarterly survey of lenders that while banks would tighten access to credit for companies in the second quarter, lending volumes were still expected to rise.

The euro added to Monday’s gains against the dollar, rising 0.2 percent to $1.0884, albeit off Monday’s high of $1.0940. The yen, however, pulled back 0.6% to 110.39 per dollar. Sterling rose 0.1 percent to $1.2806. The Canadian dollar 0.5 percent to C$1.3561 per U.S. dollar after the United States announced new duties averaging 20 percent on Canadian softwood lumber imports.

French and German 10-year government bond yields rose and the spread between them hit its tightest since November at around 41 basis points. The two-year spread was its narrowest since late January. The yield on French 10-year notes rose two basis points to 0.85 percent, after tumbling 11 basis points in the previous session. German benchmark yields added four basis points to 0.37 percent. U.S. bonds headed for a fifth day of declines, with yields on 10-year Treasuries climbing three basis points to 2.31 percent.

Gold fell 0.4 percent to just under $1,270 an ounce. Copper reversed falls in Asia and headed higher, last trading 0.7 percent higher at $5,695 a tonne. Oil prices steadied after six straight days of losses. Brent crude, the international benchmark LCOc1, was just 4 cents down on the day at $51.59 a barrel.