(Click on image to enlarge)

Issuers of investment-grade corporate bonds have been rushing to market with new sales recently as interest rates climb and rate hike risk nears.

A slew of fresh high grade financial and corporate debt priced this past week, amid an easing of geopolitical jitters in Italy, as well as ahead of the Federal Reserve’s widely expected 25bp rate hike at the conclusion to its Federal Open Market Committee (FOMC) meeting June 13.

To date, a total of roughly US$34bn of fresh investment-grade issuance crossed the tapes in May, almost 37.7% of syndicate managers’ estimates for the month, and more than 132.5% of expectations for the week, according to Ron Quigley, head of fixed income syndicate, at Mischler Financial Group.

Many of the issuers to enter the primary market this past week have hailed from the financials sector, as interest rates – while notching higher – generally continue to remain at ultra-low levels. The long list of names include Citigroup (C), Credit Suisse (CS), Dankse Bank (DNKEY), First Republic Bank (FRC), Goldman Sachs Bank USA (GS), Keybank (KEY), PNC Bank (PNC) and Toronto-Dominion Bank (TD).

The yield on the 10-year U.S. Treasury note was last quoted at around 2.94%, a backup of roughly 7bps since last Tuesday, when uncertainties over Italy’s government and status within the eurozone triggered turmoil in financial markets.

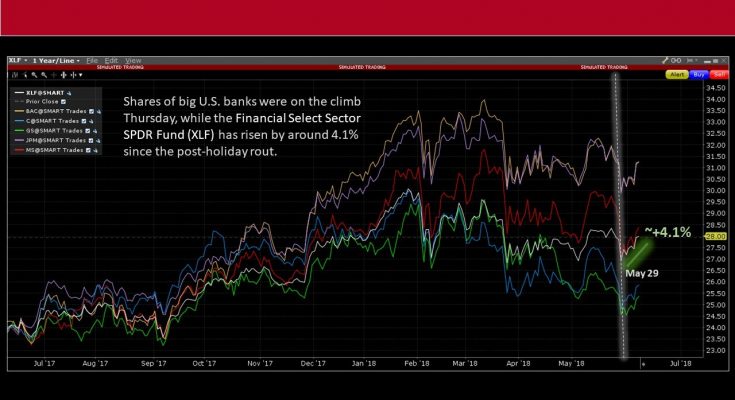

Analysts at Blue Line Futures noted the banking sector has been “on fire†as yields recover from the post-Memorial Day plummet, and a weaker U.S. dollar has “boosted earnings optimism for the multinationals.†They added that “the resiliency this market has displayed through recent and treacherous news has allowed a path of least resistance higher now that things have quieted down.â€

Shares of big U.S. banks were on the climb Thursday, with Bank of America (BAC), C, GS, JPMorgan (JPM) and Morgan Stanley (MS) each making intraday gains of between 0.30% to more than 0.90%.