Yesterday was a close one! Â

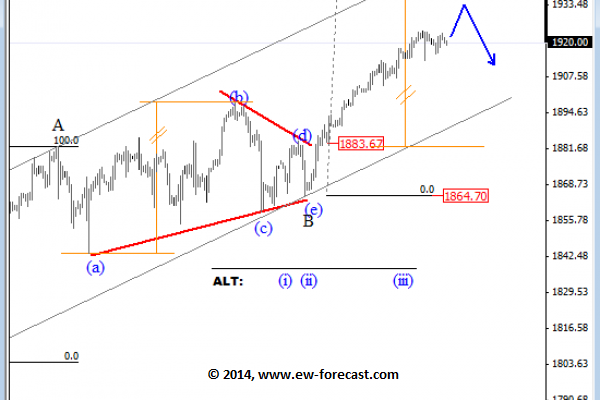

We briefly failed our first test of 1,920 (see yesterday’s notes) but another low-volume rescue kept us from fulfilling the “Wave C” prediction on this Elliot Wave chart – for now. Â

Not that I’m an Elliot Wave person, of course – my theory is that, if you are going to draw 5 points on a graph you can imagine all sorts of random patterns and SOMETIMES you will be right.  About half the time, in fact. Â

I believe in bigger numbers and our own EXCLUSIVE 5% Rule™Â says the S&P bottomed out at 800 (in 2009) doubled to 1,600 last Spring, consolidated there for a quarter and now has made a 20% move to 1,920 – just like it was supposed to since it bottomed in 2009 (see our many, many predictions over the years).  In fact, it was March of 2012, with the S&P at 1,404, when we set our new goals for the S&P to 1,600.  As I said at the time:

That’s right, it turns out our +10% line is still pretty much right on the money, only now we switch our focus to our goal of 1,600 and begin running our numbers off there, rather than from 800.  I have been (and still am) Fundamentally bearish on the market at the moment – I just think we are making this move too soon – but that is not to say I think the move is unmakeable. Â

Chart by Dave Fry

Once we did get the dip in June that we expected at the time (down 10%, back to 1,278 and, fortunately, we had cashed out our Income Portfolio before things turned ugly) we were happy to go gung-ho bullish with our Buy List – the same kind of Buy List we just finished assembling in yesterday’s Live Trading Webinar.  In fact, right in that 3/17/12 post, I laid out this play to profit from our prediction:

For example, we expect the S&P to work it’s way up to 1,600 and that’s SPY $160 and the Jan (2013) $146/154 bull call spread is $3 and you can sell the $110 puts for $3.15 so a .15 credit on the $8 spread and all we need is that 1,550 that everyone is predicting to make 5,433% on cash.  TOS says the margin on the short $110 puts is net $11 so a very nice return on cash too – if it works.  As we can stop out the spread at $2, it’s worth our while as long as we don’t believe the S&P will fail 1,100 this year.