Tax reform is high on the agenda of the new administration, leading to speculation about what changes could mean for the outlook for tax-exempt municipal bonds. This article focuses on two areas: a reduction in tax rates for both corporations and individuals, and the elimination or capping of muni tax exemption.

Written by Peter Hayes (BlackRockBlog.com)

Lower individual taxes — and a grain of salt

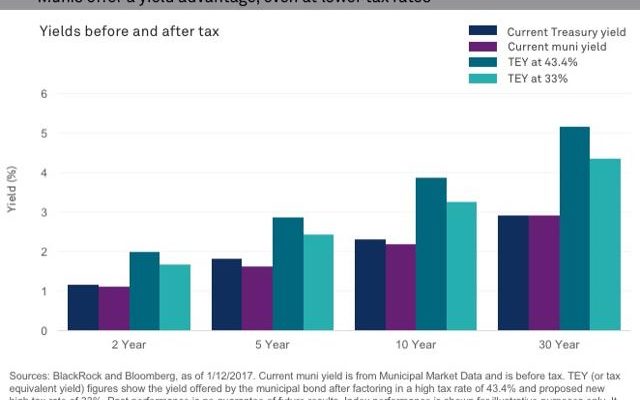

The hard truth: Lower individual tax rates reduce the value of a municipal bond’s tax exemption. For example, a drop in the top tax rate from 43.4% to 33% means $4,340 in annual savings would be reduced to $3,300. And to the extent that lower tax-exempt benefit mutes the demand for municipal bonds, market valuations could suffer.

To that salty dose of reality I would add two important provisos:

- The individual tax code is very complicated and politically difficult to amend, even under one-party control. Change may well come, but not likely in 2017 as Washington focuses on the comparatively easier task of corporate tax reform.

- A cut in individual tax rates would cause some adjustment in muni pricing (read on for our estimate). But the market has seen similar, and even more dramatic, tax changes before. The top marginal tax rate was reduced from 50% to 28% in 1986 and from 39.6% to 35% in the 2000s. And, under current conditions, muni investors still reap an after-tax benefit over taxable bonds, even at a 33% tax rate.

Â

Tax exemption not dispensable

The tax exemption of municipal bond interest is a key draw for issuers. And while it may be deemed alterable, we don’t see it as dispensable. States and municipalities rely on municipal debt as a low-cost, efficient way to finance capital improvements and fund infrastructure. The federal government hurts itself if it impedes state and local ability to create jobs, sustain their economies and improve the quality of life for Americans. As such, we see the elimination of muni tax exemption as highly unlikely.