Federal Reserve Chairwoman Janet Yellen told the crowd last week that rate hikes are coming. The rise will be gradual, she said, but there’s an upward bias for the road ahead. “With continued improvement in economic conditions, an increase in the target range for [the federal funds rate] may well be warranted later this year,†Yellen advised. But getting from here to there faces a rough road, including what’s shaping up to be a disappointing start for growth in this year’s first quarter. Meantime, the Treasury market is nonplussed by Janet’s latest comments. Yields on government bonds remain well below recent highs, effectively telling the Fed that the future looks somewhat different relative to the narrative that the Fed chair is pushing.

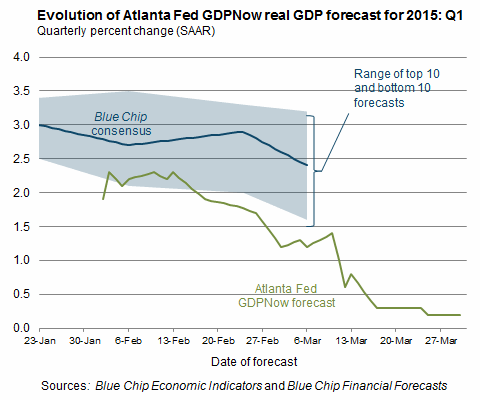

Consider yesterday’s update of the Atlanta Fed’s estimate for first-quarter GDP. The bank’s currently projecting that growth came to a virtual standstill in the first three months of 2015, rising just 0.2% — well below the 2.2% pace in last year’s fourth-quarter and a world below Q3’s 5.0% surge.

The optimistic view is that this year’s sluggish trend is a temporary setback due to a harsh winter. Some of the recent economic reports offer support for that view, although you could just as easily point to the disappointing updates in recent weeks to argue the opposite. Not surprisingly, the crowd doesn’t appear to be impressed one way or the other. The benchmark 10-year yield, currently at just below 2.0%, hasn’t moved much in recent days and is is well below the recent high of 2.24% that was touched in early March. A similar story applies to the 2-year yield, which is widely considered to be the most-sensitive maturity for rate expectations.

Economist Tim Duy, a veteran Fed watcher, reasons that “Yellen intends to look through any first quarter weakness in GDP data, seeing it as largely an aberration (like arguably the first quarter of last year), as long as the employment data continues to hold up.†He adds that “I doubt any one weak report would do much to undermine her confidence in the recovery; we should be focusing on the story told by the next three employment reports in aggregate.â€