Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt.

If you want to know why the Status Quo is unsustainable, just look at interest and debt. These are not difficult to understand: debt is a loan that must be paid back or discharged/written off and the loss absorbed by the lender. Interest is paid on the debt to compensate the owner of the money for the risk of loaning it to a borrower.

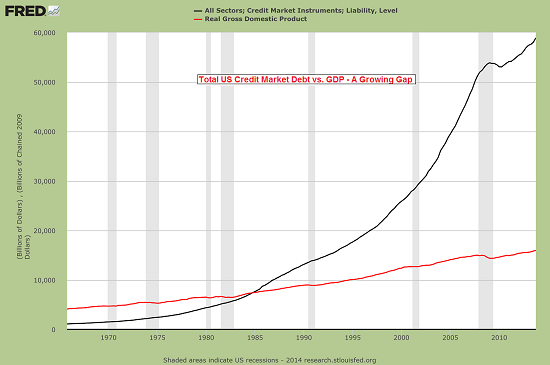

It’s easy to see what’s happening with debt and the real economy (as measured by GDP, gross domestic product): debt is skyrocketing while real growth is stagnant. Put another way–we have to create a ton of debt to get a pound of growth.

There is no other way to interpret this chart.

source:Â Acting Man

The Status Quo has only survived this crushing expansion of debt by dropping interest rates to historic lows. This is a chart of the yield on the 10-year Treasury bond, which reflects the extraordinary decline in interest rates over the past two decades.

The Federal Reserve has pegged rates at essentially 0% for years. That means the strategy of lowering interest rates to enable more debt has run out of oxygen: rates can’t drop any lower, and so they can either stay at current levels or rise.

Near-zero interest rates for banks borrowing from the Fed doesn’t mean conventional borrowers get near-zero rates:Â auto loans are around 4%, credit cards are still typically 16% to 25%, garden-variety student loans are around 8% and conventional mortgages are about 4.25% to 4.5% for 30-year fixed-rate home loans.

This decline in interest rates means households can borrow more money while paying the same amount in interest.

So the interest payment on a $30,000 car today is actually less than the payment on a $15,000 auto loan back in 2000.

source:Â The Born Again Debtor

The monthly payment on a $400,000 home mortgage is roughly the same as the payment at much higher rates on a $200,000 home loan 15 years ago.

So dropping the interest rates has enabled a broad-based expansion of debt across the entire economy. Notice how debt has exploded higher in every segment of the economy: household, finance, government, business.

source:Â The Born Again Debtor

The other half of the debt/interest rate equation is household income:Â if income is stagnant and declining, the household cannot afford to take on more debt and pay more interest. With real (adjusted for inflation) household income declining for all but the top 10%, households cannot take on more debt unless rates drop significantly.

Now that rates are at historic lows, there is no more room to lower rates further to enable more debt. That gambit has run its course.

Many financial pundits claim private debts can simply be transferred to the government and the problem goes away. Unfortunately, they’re dead-wrong. As economist Michael Pettis explains, bad debt cannot simply be “socializedâ€:

Â