There has been a great deal of talk about the housing recovery. Sales of existing homes steadily rose between mid-2011 and mid-2013 on the back of a weak U.S. dollar and an increase in the money supply. Indeed, Federal Reserve monetary policy had stimulated demand for U.S. stocks as well as U.S. real estate. Yet from the moment the Fed announced its intention to pull back on its unconventional program of creating electronic dollars to buy U.S. bonds, property sales began to slide alongside rising interest rates.

Since January of this year, however, the 10-year yield has reversed direction, from a high of 3.03% back down to 2.53%. The 50-basis point move has provided a boost to actual sales in the 2nd quarter as well as a lift to home-builder sentiment. On the other hand, sales are still 20%-25% lower than they were at their peak and they have already been slowing in “hot markets†like Southern California. Year over year, Los Angeles and San Diego have experienced declines in home sales of 12% and 19% respectively.

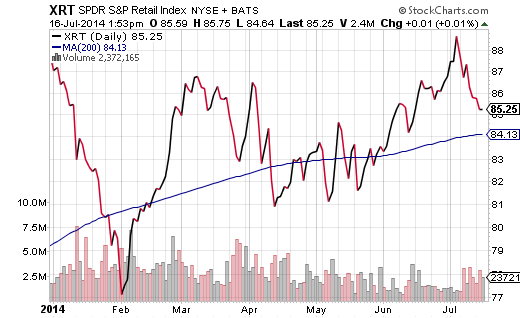

From the data that I am looking at, it is difficult to see how real estate will contribute significantly to economic growth. For that matter, the consumer has not been spending at retailers or buying residential properties, challenging the notion that Main Street is feeling confident about the current expansion. The fact that SPDR S&P Homebuilders (XHB) as well as SPDR S&P Retail (XRT) are negative in 2014 reflect this economic uncertainty.

Â

“Come on, Gary,†you argue. “The economy must be on solid footing or the Dow and the S&P 500 would not be hitting all-time highs.†I respectfully disagree. Not only is the remarkable performance of long-term U.S. Treasuries in 2014 highlighting weaknesses – not only did the Bank of International Settlements (BIS) describe euphoric asset prices as being out of touch with global economic reality – but even Federal Reserve Chairwoman Janet Yellen discussed the feverish valuations of sectors like biotech and dot-com/social media. Biotech has held up better than social media on the year, though both areas have been remarkably volatile as of late.