By Jimmy Atkinson, ETF Reference

Six years into a bull market, U.S. equities are no longer the bargain that they were in 2009.

Since 2013, the Dow Jones Industrial Average has closed at a record high 95 times — most recently on May 18, 2015. While it’s impossible to predict the future, and while no single metric is without flaws, several fundamental valuation ratios indicate that the U.S. stock market is currently trading at a premium compared to its own history, compared to other countries and regions, and when considering future return projections. Below are 10 charts that make use of these valuation ratios and return projections to illustrate this point.

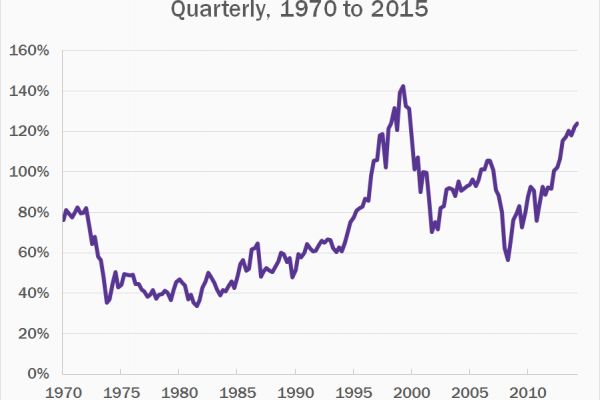

The “Buffett Ratio†suggests the market is overvalued by 34 percent.

In a 2001 interview with Fortune magazine, Warren Buffett praised the total market cap to GDP ratio as “probably the best single measure of where valuations stand at any given moment.†Typically, the stock market is deemed “fairly valued†when the TMC/GDP ratio is between 75 to 90 percent. Over 115 percent qualifies as “significantly overvalued,â€Â per GuruFocus. Today’s TMC/GDP ratio is 124.1 percent, firmly in “significantly overvalued†territory and nearing historic levels.

Â

Â

Data sources: Federal Reserve Bank of St. Louis and multpl. This metric is calculated by dividing the Wilshire 5000 Full Cap Price Index by the most recent GDP figure.

The S&P 500 CAPE ratio is approaching 2007 levels.

Cyclically Adjusted PE (CAPE) — also known as the Shiller PE ratio — is a volatility-adjusted measure of price-to-earnings ratio. As of June 2015, the S&P 500 CAPE is 61 percent above the historical average. While it has a ways to go before reaching historic highs set during the dot-com boom, it is well above where it was at the beginning of the recession of 1937-38 and the 1973-74 stock market crash, and closing in on levels last seen at the start of the financial crisis of 2007-08.