- GBP/USD has been benefiting from the dollar’s pause in gain.

- While the vaccine truce is positive for the pound, fresh dollar strength is likely.

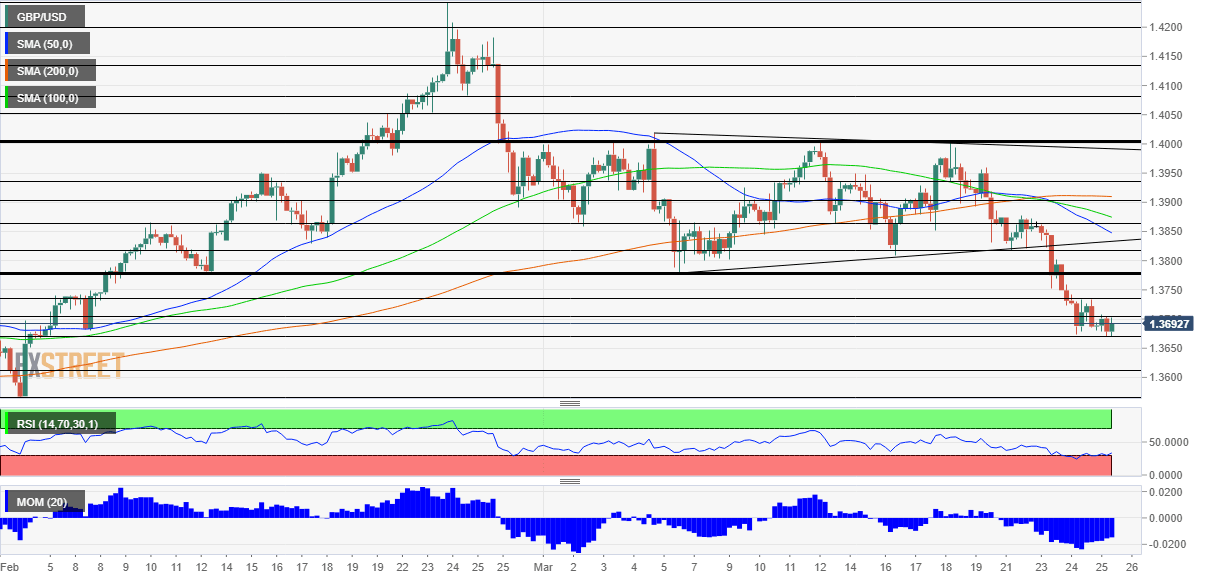

- Thursday’s four-hour chart is showing that cable is near oversold conditions.

Passport for having a pint? Government plans to make pubs responsible for admitting people according to their vaccination status are part of the UK’s issues when it comes to reopening, but that return to normal depends on vaccine supply. Some good news on that front has supported sterling, but will it last?

The EU and the UK kicked off talks to defuse tensions around vaccine distribution and released an initial statement in which they vowed to strive for a “win-win” situation. Assuring an ongoing supply of doses is positive news, but progress hinges on calm at Thursday’s EU Summit. If the bloc’s leaders vent frustrations of their citizens and point fingers at Britain’s, the pound could further suffer.

However, the more significant pressure on cable will likely come from the other side of the Atlantic. The safe-haven dollar has been falling as the market mood improves following Wednesday’s decline in stocks but may find fresh reasons to rise.

First, infrastructure spending has growing chances of becoming reality after moderate Democratic Senator Joe Manchin gave his blessing. New government investment may trigger inflation and push the Federal Reserve to raise rates sooner rather than later. Funding will partially come from tax hikes on corporations – and that may dampen the mood on Wall Street, adding to a flight to USD safety.

Why the dollar is rising while yields are falling, blame it on the taxman

US President Joe Biden is set to deliver a speech on the economy next week, and in the more immediate term, US jobless claims could boost the greenback. After jumping two weeks ago, they dropped last week and are set to extend their trend.

US Initial Jobless Claims Preview: Vaccination and economic progress

The final read of growth figures for the fourth quarter of 2020 are also eyed, and will likely confirm the 4.1% annualized growth rate.

The February Grab-Bag Preview: Personal Income, Spending, Core PCE Prices and GDP

All in all, even if sterling finds reasons to rise, a return of dollar strength could push cable down.

GBP/USD Technical Analysis

Pound/dollar continues suffering from downside momentum on the four-hour chart and is also trading below the 50, 100, and 200 Simple Moving Averages. However, the Relative Strength Index is near 30 – flirting with oversold conditions.

Support awaits at the March low of 1.3675, followed by 1.3610, a resistance line from early February. Further down, 1.3565 is a critical cushion.

Initial resistance is at the daily high of 1.3720, followed by 1.3740. The broken double-bottom of 1.3775 is a strong cap.