Written by Patrick Watson

The Federal Reserve hiked interest rates again last week. Yes, it was a tiny hike, but as they say, “A quarter-point here and a quarter-point there, and pretty soon you’re talking about real money.â€

Higher rates aren’t entirely bad. They might help savers holding cash—though I wonder why anyone would still hold cash after almost a decade of punishment. The Fed has forced Americans into riskier assets, using every tool but horsewhips.

The bigger question is what this tells us about future Fed policy. Given that the Fed’s composition will probably change in the next year, what if we let the math decide?

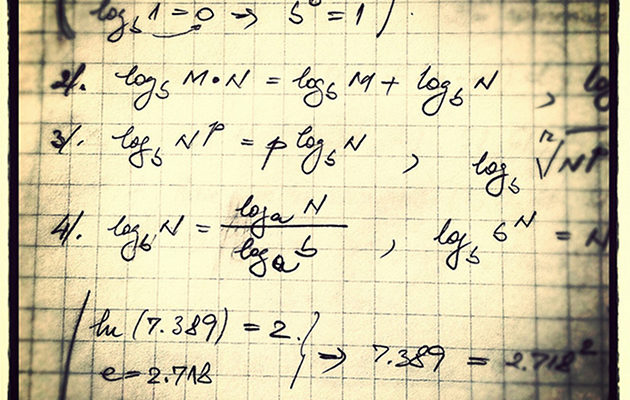

Image: Albastrica Mititica on Flickr

Fed Formulas

This summer I’m taking an algebra class at Austin Community College. Math’s right-or-wrong nature presents a nice change from the ambiguity of macroeconomics and monetary policy.

One evening last week, I sat on my deck, happily solving equations from my algebra book—not thinking about economics at all—when I saw this.

Since there’s evidently no escape for the Fed-weary, let’s discuss this formula.

Harvard economist Greg Mankiw designed it to assess what interest rate the Fed should target, based on inflation and unemployment.

At the time (mid-2006), the unemployment rate hovered around 4.6% and core inflation 2.4%. Plug those numbers into Mankiw’s formula, and you get a 5.42% rate target. The actual fed funds rate was 5.25%, so not far off.

However, that picture has changed quite dramatically.

The Fed’s preferred inflation gauge, core PCE, is up 1.7% since this time last year, and the unemployment rate is 4.3%. So according to Mankiw’s formula, we would expect a fed funds rate of 4.86% right now.

It’s not even close. Last week, the Fed raised the rate to the 1.0–1.25% range.

Even the most hawkish FOMC voter (whoever it is) doesn’t foresee rates touching 4% before 2019. And all the others predicted much lower rates than that.