Later this week another Fed meeting will pass with the policy rate still pinned to the zero bound. May will make the 77th consecutive month at ZIRP—–an outcome that would have been utterly unimaginable even a decade ago, and most especially not with the unemployment rate at 5.2% and after 23 quarters had elapsed since the end of the official end of the recession.

There never was an Armageddon-like crisis in 2008 that justified all this; it all happened because two emotionally unstable and misguided high officials—Ben Bernanke and hank Paulson—-panicked Washington into the utterly false fear that Great Depression 2.0 was at hand. But not withstanding all the crony capitalist larceny that this financial terrorism enabled, it is impossible to say that with the stock market at 2100—-50% above its pre-crisis level—that there remains any justification for maintaining these “extraordinary policies seven years later.

In fact, the Fed’s cowardly dithering for yet another meeting this week has precious little to do with the so-called Great Financial Crisis—-the ostensible reason why we ended up with perpetual free money subsidies for financial market speculators. Instead, it is a product of a policy ideology and insular culture that has been building at the Fed and most other major central banks for more than two decades.

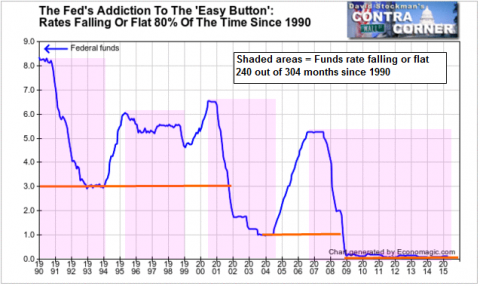

Central bankers now have their big fat thumbs perpetually on the Easy Button because they are addicted to it. In the case of the Fed, it has been in a rate cutting or rate holding mode during 80% of the time since 1990. Stated differently, during 240 of the last 304 months, the Fed has been riding the Easy Button.

Â

The Fed’s Addiction To The ‘Easy Button’: Rates Falling Or Flat 80% Of The Time Since 1990 – Click to enlarge

This is not just a case of a excess of zeal or too much of a good thing. In fact, the above chart constitutes just one more piece of evidence that world’s financial system is being destroyed by a few hundred central bankers and a couple of brigades of PhD’s and policy apparatchiks which populate their bounteous payrolls. Over the last two decades, this infinitesimal slice of mankind has engaged in a campaign of mission creep that dwarfs all prior aggrandizements of state power.

The result is that free market price discovery has been extinguished. The central nervous system of capitalism—-the markets for money, debt and other capital securities—-now goose-steps to the pegged prices and monumental liquidity infusions of the central bankers.

The truly diabolical aspect of this development is that central banks have seized an enormous aggregation of power that is utterly unaccountable, meaning that an increasingly threadbare ideology of self-justification goes unchallenged. Moreover, this exemption from accountability insulates the actions and theories of central bankers in a manner that is different than all other institutions of the modern world. Namely, central banks are flat-out exempt from the discipline of both the market and the democratic process. Indeed, they are the most unaccountable concentrations of power since the era of absolute monarchy.

It is not hard to understand why this astonishing coup d’état has been so easily achieved. It suits the politicians just fine because the resulting massive monetization of the public debt has enabled nearly pain-free fiscal profligacy. The ancient threat of rising interest rates “crowding out” private investment has been eliminated long ago, thereby making “kick the can†the fiscal policy of choice.

Likewise, the central bank coup has generated its own praetorian guard in the financial system. That is, a giant class of speculators now exists in the form of hedge funds, traders, money managers and investment bankers which would not have a fraction of their current girth in an honest, at-risk financial system.

Needless to say, this giant speculative class is showered with immense windfalls in the casino system that inexorably supplants traditional financial markets under a regime of modern Keynesian monetary policy. The speculative class, in turn, returns the favor in the form of political support for the so-called “independence†of the Fed and in via embracing the self-justifying ideology of the central bank usurpers.