Currently, Santander (NYSE:SAN) has been perceived as another Southern European bank. However, Santander is the biggest Euro zone bank, in terms of market capitalization, with presence in several high profile markets like: UK, USA, Brazil, Mexico, Germany, among others.

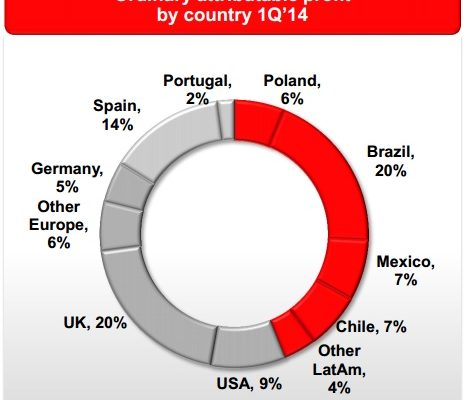

Graph 1 – Santander Profit Distribution (Source: Santander strategy presentation)

Looking to the Graph 1, we can see that the company’s profits are not dependent on a single geography. This, probably, helps to explain why this Spanish bank did not have any quarterly loss since 2007 (Source:Santander strategy presentation). On the other hand, the stable earnings base has helped the bank achieving a total capital ratio around 12.1%, which is well above the 8% minimum required.

Strong liquidity position helps business

With a stable and diversified earnings source and a strong capital position, Santander has been mostly focused in streamlining its current operations while making some acquisitions, taking the opportunity to close interesting deals. One of those deals, the acquisition of a 470 million stake in Bank of Shanghai (Source:Â Financial Times), perhaps signals an incursion into the Asian banking market. While other banks in trouble have been mostly selling good assets in order to boost capital ratios, Santander has been able to take an opportunistic approach to the current environment.

The opportunistic banking deals have been in Santander’s DNA for a long time. In 1993, Santander bought a significant position in the US bank First Union (Source: High Beam). In 1997, Santander sold the position at a hefty profit, just in time to buy the Brazilian Bank Banespa in the beginning of the millennium (source: New York Times). Needless to say, Brazil represented 20% of Santander’s profits in the 2013 exercise.

Since 2008, Santander has been on a spree of acquisitions. The bank took advantage of the opportunity created by the financial crisis, to buy the totality of the Sovereign Bank (Source: Bloomberg). From 2010 to 2012, Santander bought two Polish banks, which together are worth around 10% of the market share in deposits (Source: Bloomberg). As we can see in Graph 1, the US and Poland, already represent 15% of the Santander’s profits.