The term “lower for longer†has been coined by the financial media to describe the most recent period of low interest rates over the last 6 years.

It was unthinkable 6 years ago that today, 6 years later, the 10 year Treasury Bond rate would be sitting at about 1.5%. Because the income from bonds and other interest bearing investments is paltry, investors are turning more and more towards investments in dividend paying stocks and master limited partnerships (MLPs).

I had previously been squarely in the camp that believes we would see interest rates increase toward a more typical (or normalized) level driven by GDP growth, employment growth, wage growth, and healthy inflation. Over the last year I have read through dozens of articles including a number on economic history, taught a class in economics and investing, and given this subject a lot of thought.

As a result, my thinking has evolved to an alternate possibility. The US and much of the developed world may very well see interest rates low for very much longer, possibly decades.

Interest Income vs Dividend Income Today

Interest rates today are pretty low.The US 10 year Treasury Bond yields 1.5% and 30 year conventional mortgages can be found as low as 3.2%.

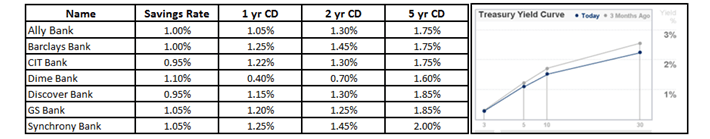

Companies with investment grade credit ratings can get loans or issue bonds at very favorable rates providing cheap capital for growth. This is all great news if you are in the market for a loan. But if you are in the market for debt based investments (bonds, bank deposits, mortgage securities), you will likely have to lower your expectations for returns. The chart and table below provide a summary example of the returns you can expect today from investments in US bonds/notes and bank deposits.

Source:Author

This is about as good as it gets for a “safe†return.All of the banks listed in the chart above are “online†institutions.Most brick and mortar bank’s money market funds are paying 0.1 to 0.2% interest and it is hard to get excited about purchasing a 10 year Treasury at 1.5%.

Many investors have turned to alternate investments than can provide a better return in exchange for higher market and/or credit risk.A number of new bond funds (ETFs and CEFs) have cropped up that use 2x or 3x leverage to boost income returns. While these leveraged funds have become quite popular with income investors, one needs to understand that leverage can be used to juice returns in a bull market but it also exacerbates losses in a bear market.

Dividend paying stocks are another option for investors seeking current income.I’ve written about a number of dividend paying stocks – including the Top Canadian Banks and The Best Monthly Dividend stocks – on Sure Dividend.

Sure Dividend’s stock recommendations have all been carefully researched and screened for income and total return potential but, like any equity investment, there is both market and credit risk associated with their ownership. For that additional risk of equity ownership, investors are being compensated with yields of up to 7.5%.It is no wonder income seeking investors have turned towards dividend paying stocks to generate current income.