Following RBI governor Urjit Patel’s Op-ed earlier this week, in which he lamented the growing dollar shortage as a result of the Fed’s ongoing tightening, it is perhaps not surprising that this morning India became the latest central bank to “surprise” markets with an unexpected rate hike as the country did everything it could to if not prevent, then delay the capital outflow Patel hinted at.

And it was a “surprise”, because only a third, or 14 of 44 economists surveyed by Bloomberg, predicted the RBI would hike the repurchase rate by 25 bps to 6.25%, as it did, with the rest predicting an unchanged announcement.

To be sure, the decision was welcomed domestically, where inflation has been trending higher, and Economic Affairs Secretary Subhash Chandra Garg said in a twitter post that he Welcomes the “monetary policy statement. Quite balanced assessment of growth, inflation and external situation and expectations.”

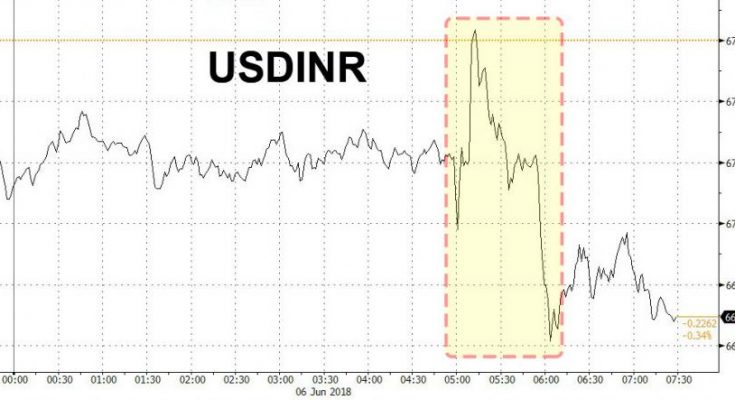

The market was a bit more tempered, although after an confused initial reaction to the hike in the INR, which first jumped, the slumped, it eventually closed near session highs, just as the RBI had intended.

(Click on image to enlarge)

The desired response may not last, however.Â

In a note by Bloomberg’s Abhishek Gupta, the economist writes that the rate hike may not help the rupee, because as a standard rule of thumb, while raising interest rates attracts capital inflows, causing the local currency to appreciate, this is generally only true for developed economies, and doesn’t necessarily hold for emerging markets, where capital typically doesn’t have free mobility. For that reason, a rate hike by the Reserve Bank of India “would likely add to downward pressure on the rupee, which is already suffering from higher crude oil prices.”

Perhaps Gupta is right, but at least the kneejerk move was as one would expect. As for tomorrow, we’ll see.