Â

Â

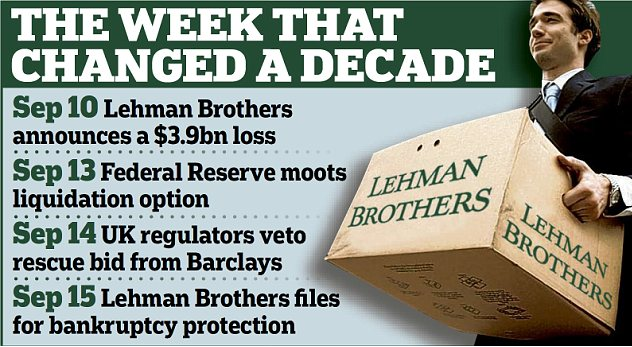

It’s 10 years since my forecast of a global financial crisis came true, as Lehman Brothers collapsed. I had warned of this consistently here in the blog, and in the Letters column of the Financial Times. But, of course, nobody wanted to listen whilst the party was going strong. As the FT’s world trade editor wrote at the time, commenting on the Queen’s question “Why did nobody see this comingâ€:

“Why didn’t people see it coming? Some did, Ma’am. Some did. But it doesn’t mean they were listened to. And there is a long history of people in authority running up vast debts without public accountability and eventually losing their heads. Let’s just try and get through this one without a civil war, shall we?â€

That rationale, I understood. I was the “party pooper†warning of crisis for nearly 2 years. But people didn’t want warnings. And, of course, until we got to March 2008 and Bear Stearns collapsed, I couldn’t answer their all-important question, “When is this going to happen?â€.

If you take the 4 great questions of life – Why, What, How and When – the ‘When’ question is really the least important:

- If you know ‘Why’ something is going to happen, ‘What’ it involves and ‘How’ it will impact, then ‘When’ is simply the detail that confirms the analysis was right

- But if you don’t want to know about a problem, its the easiest thing in the world to dismiss it by arguing “your comment is no use to me, unless you can tell me when its going to happenâ€

Â

Â

But I admit that what did surprise me, after John Richardson and I had written Boom, Gloom and the New Normal: how the Western BabyBoomers are Changing Demand Patterns, Again, was that people really liked our analysis of the impact of demographic change on the economy – but still ignored its implications for their business and the economy.