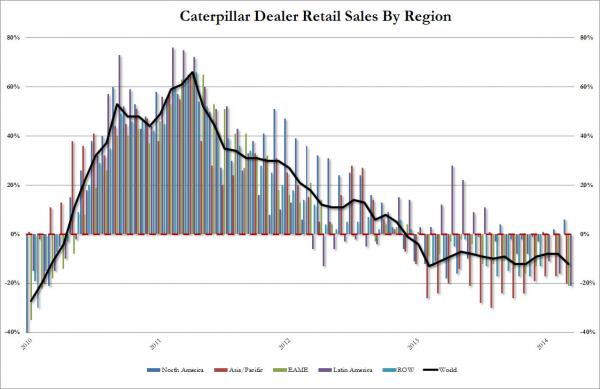

As we reported yesterday, the “reason” why CAT stock price hit its 2 year high is because as the company reported yesterday, retail sales by dealers had tumbled to the lowest level in over a year.

To be sure, nobody expected a blowout number at the CAT topline… and nobody got one either: with Q1 2014 revenue of $12.493 billion, unchanged from the $12.484 billion year ago, there was no sales growth to talk of. In fact, if one merely looks at the Net Income line, one won’t see much if any difference to talk about, with both Q1 2013 and 2014 profit reported at $0.9 billion.

And yet, EPS soared from $1.31 to $1.44, which using some more non-GAAP magic, one can get to $1.61 when adding back recurring, non one-time (thank you Alcoa and JPM) restructuring charges. This compares to EPS estimates of $1.23.Â

So just how did CAT succeed in boosting EPS even as its top line was flat at best, and when in reality this is likely just a deferred revenue timing gimmick considering global retail sales in Q1 have crashed compared to a year ago?

The answer, which we will merely show without explaining as we have covered this topic time and time and time again, is shown in the chart below (hint:Â CapEx -50% offset by Buybacks rising by #DIV/0!).

Thank you stock buybacks and other shareholder friendly activities which reward activists at the expense of the company’s future growth prospects and, of course, its employees. Because we should also note that CAT had 116,579 total full time employees in Q1, down 8,295 from 124,874 a year ago.

But at least the stock is soaring.