When it comes to Net Lease investing many believe that sourcing free-standing properties is a simple task, however that could be furthest from the truth.

Net leased properties are owned because of their defensive long-term lease characteristics; however, the true value for a skilled net lease investor is to aggregate a portfolio of high-quality free-standing properties that offer both low risk and high returns.

I place considerable value on the Net Lease REIT management teams who have been able to provide meaningful differentiation in both sourcing deals and managing portfolio risk. Collectively it’s skillful risk control that propels the share price of the underlying security in which the market distinguishes the best from the rest.

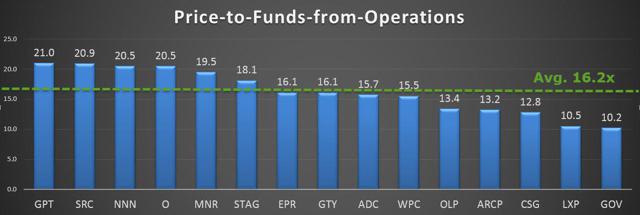

When considering the market valuations (or P/FFO) for the peer group, it’s plain to see that there are a few skilled Net Lease investors. Arguably, many REITs are trading slightly above their historic norms but that tells me that management is doing something right.

My job though is not finding Net Lease properties or even management teams that offer the best-in-class risk management strategies. Instead, I’m looking for the best Net Lease REITs at the cheapest overall price. Clearly, there are no bargains with the REITs that are trading above the dotted green line (above), but I see one below it.

W.P. Carey’s Safe and Reliable Dividend

Recently W.P. Carey (NYSE:WPC) announced an increase in its quarterly dividend to $.95 per share.

Continue reading this article here.Â