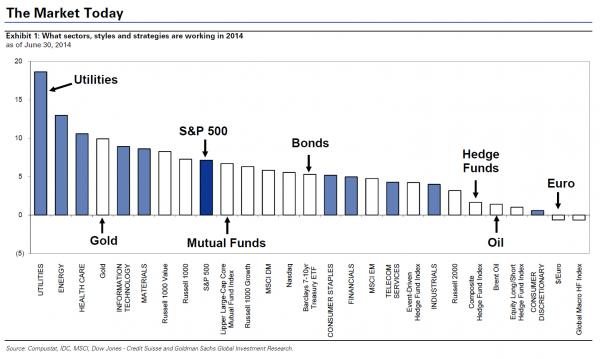

Remember when stable, self-sustaining recoveries were led by Utility stocks outperforming every other asset class and sector (and returning 3x Financials)? Neither do we. But as the following chart showing the performance of all the sectors, styles and strategies in the first half of 2014, it just doesn’t matter.

The reason: with virtually every asset class generating positive returns, there was something for everyone in the first half. Well, everyone except macro hedge funds: they were the only asset class (since we are not quite sure how to classify the EURUSD) that was down so far in 2014 with the broader hedge fund universe barely doing much better at just up 2% in the first half, continuing its inability to outperform the S&P for the 6th consecutive year – an S&P which as we keep repeating, simply needs no hedges – after all, it is m[i|a]ro managed by the biggest Chief Risk Officer of all, the global central bank consortium. And when the Fed finally fails, no amount of short hedges will be able to offset what comes next.

Source: Goldman Sachs