The BLS tells us that shelter inflation in the last year is only 2.7%. The shelter category includes rent and owners equivalent rent. It accounts for 32% of the entire CPI calculation. The BLS drones tell us that rents only went up 2.9%, while owners equivalent rent went up only 2.6%. It must be nice living in the world of models and assumptions. Too bad the rest of us live in the real world.

Monthly rental costs reached an all-time high today of $766 per month. This is up 6% versus one year ago. Rents were up 16% in the Northeast versus last year. How exactly does the BLS get off trying to convince the clueless public that rents only rose by 2.9%? Which figure do you believe?

Case Shiller came out with their home price data this morning based upon actual home sales. Home prices surged by 12.9% versus last year, with some cities seeing gains greater than 20%. If home priceshave surged and mortgage rates have surged, how can owner’s equivalent rent only increase by 2.6%? Inquiring minds want to know.

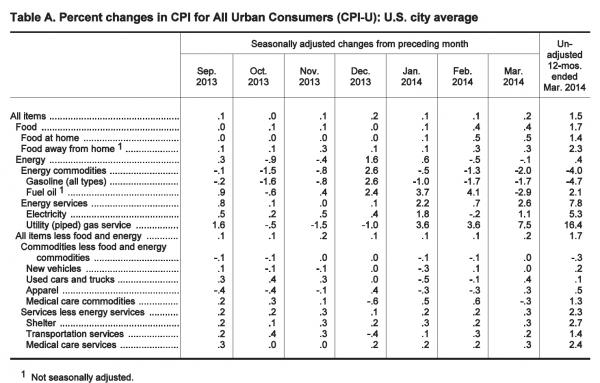

So let me get this straight. Rents are increasing at 6%. Home prices are increasing at 13%. Gasoline prices are at 9 month highs, up by 13% since November. Natural gas is up 11% in the last month and 10% higher than one year ago. Beef prices are at all-time highs. Food prices are surging in general.Health insurance premiums are skyrocketing by 10% or more. Tuition increases are off the charts. And Janet Yellen is worried about deflation?????

It’s called the American Dream because you’d have to be asleep to believe it.