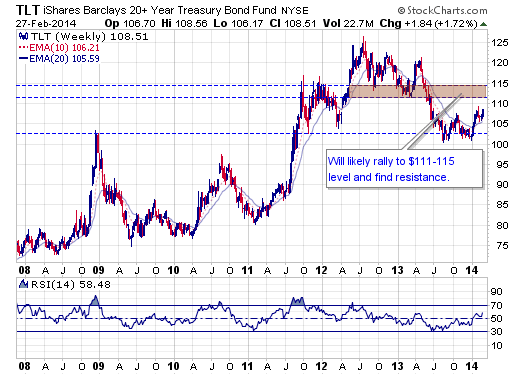

I continue to believe the bull market in bonds is over and these will trade lover over the coming years, however small rallies within that downtrend will appear from time to time. Should this continue to bounce off the 2009 highs, which has now become resistance, this could bounce into the $111-115 range before it’s next major sell-off begins. The next sell off should take us down to RSI levels close to 20 which would officially confirm this sector is in a bear market. The RSI has been getting progressively weaker, but until it trades down to 20 I won’t be convinced, because the RSI oscillates between 60-20 and so far 30 has given it support.