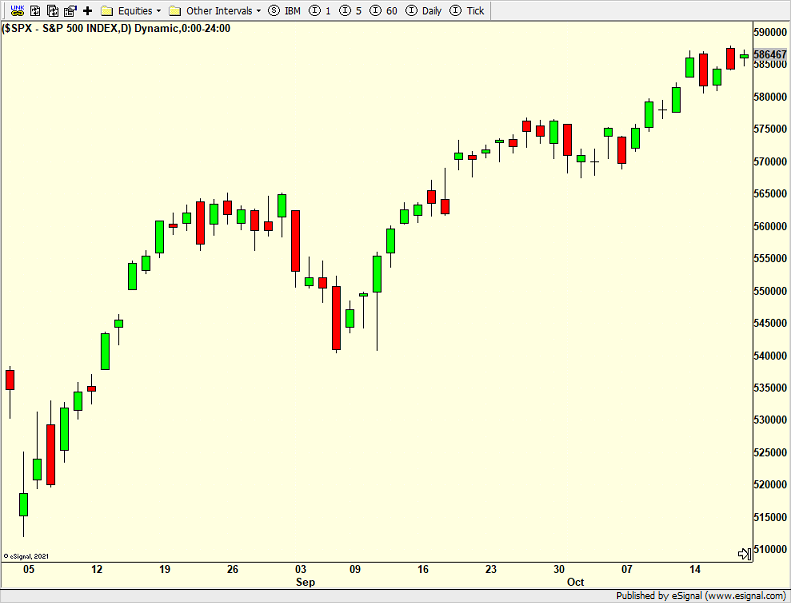

The markets open the week with a range of all-time highs. Furthermore, lots of folks shared that the stock market hasn’t had back to back down days in more than 30 days. That is the epitome of strong momentum and buying every dip. Since the mini-crash on August 5th, there have been only two decent down days. I think that’s going to change this week.(Click on image to enlarge)

This rally has flown in the face of seasonal factors which argued for weakness in September and October, both election year weakness and all years. October usually sees a good first week and then softness for three weeks. So far, not this year.Last Friday was monthly options expiration. There is a mild seasonal trend for lower prices this week.Lots of pundits and those in the media are now arguing that the rally in stocks, especially small caps, as well as crypto is all because markets are sensing a Donald Trump victory. I think that’s a dangerous and wrong position to take. Historical data do not suggest that conclusion. Investors need to be patient and let the markets play out until the end of the month. Watch reaction to good and bad earnings. Be a little wary when you hear the paid actors on TV tell you the stock market has asymmetric risk, higher or flat. Comments like that often occur right before the rug gets pulled.On Friday we bought FOCT, and more . We sold , FNOV, and some and some .More By This Author:

When Paid Actors Tell You The Market Can’t Go Down