The Social Media Bubble

Facebook’s $19 billion takeover of WhatsApp (largely financed by issuing more of FB’s inflated stock, hence the price tag is in a way actually an illusion) has predictably produced a very wide range of reactions. Jeff Macke at Yahoo’s Daily Ticker was describing it as a ‘brilliant deal’, heaping scorn on critics who in his opinion just don’t understand the value of a business employing metrics other than the money it actually makes (or stands to make in the future even under very generous assumptions, since a major attraction of the service is that it is actually free for one year, and thereafter costs a pittance). “They’ll eventually figure out how to make money from itâ€, according to Macke. Perhaps; Facebook’s shareholders were no doubt relieved to hear it.

On the other end of the spectrum of reactions,  Peter Schiff is criticizing it as just another outgrowth of the latest Fed-induced credit and asset bubble, noting that such pricey takeovers are typically only seen when oodles of money from thin air have flooded the system.

The valuation metrics applied to the WhatsApp acquisition are clearly a throwback to the infamous ‘eyeballs’ measure that was fashionable to determine the value of various internet stocks in the late 1990s stock market bubble. On the other hand, Mr. Macke has a point when he notes that a large user base is probably more valuable than it appears based on traditional valuation measures such as current profitability (which is essentially non-existent in this case). Stock market traders often love companies that have no earnings whatsoever and instead have a large ‘fantasy’ component. As long as there are no hard data on earnings, there can be no ‘earnings disappointments’ either – instead one is free to fantasize all day long what the business might one day make. The sky’s the limit.

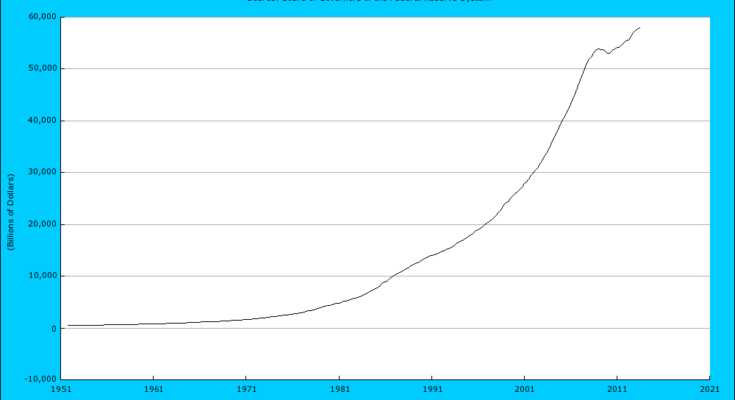

There can of course be no doubt that there is a major asset bubble underway. The true broad US money supply TMS-2 has risen by about $4.7 trillion since the beginning of 2008, an increase of roughly 90%. Its current still massive 8.2% year-on-year growth rate actually represents a slowdown. Whenever the money supply increases, pricessomewhere in the economy will inevitably rise. It is in the nature of the distribution process of newly printed money that it initially tends to enter the markets in which titles to capital are traded. This in turn makes such seemingly absurd takeover prices possible – FB’s stock has risen to a recent trailing P/E ratio of 116 and it has used mainly its inflated stock for the purchase (there is a $4 bn. cash component as well).

Incidentally, the value of the deal exceeds the amount of money raised by FB upon its listing.

US money TMS-2 (broad true money supply) – picture of a massive inflation since the year 2000, accelerating markedly since 2008 – click to enlarge.

Clearly, the ‘social media’ bubble is a close cousin to the internet bubble of the 1990s. The business concept certainly has merit, but massive money supply inflation combined with a good ‘story’ that is driving investment in these stocks has by now resulted in a run-away bubble in valuations. This ensures that capital malinvestment is occurring, since malinvestment is a result of the distortion of relative prices in the economy due to inflation. Even so, it is not our intention to be critical of those attempting to make money from this bubble. It is after all an excellent way to protect the value of one’s savings against the central bank’s inflationary policy, just as long as one is able to exit in time. In the end there will be numerous people left ‘holding the bag’ when the bubble collapses (traders misjudging the situation at a critical juncture), but it is not up to us to criticize the activities of speculators – the ones best able to foresee future developments will reap well deserved profits, while those unable to do so will be weeded out by suffering losses.

Â

Facebook – a darling of speculators in the social media sector of the market. Many have reaped large gains, but some will be left holding the bag when the asset bubble eventually deflates – click to enlarge.