Image Source:

Image Source:

This week, America voted. President-elect Trump re-gained the White House to become the 47th President of the United States next year.The Republican party took decisive control of the Senate, while the House has votes for seats that are still being counted.The results reflected vivid discontent with the state of the U.S. economy. The fact that wages haven’t kept up with inflation in most U.S. counties consolidated numbers for Trump. Related economic instability answered the question – are you better off today than you were 4 years ago – with a resounding no. When inflated prices eat up wages and people can’t afford basic bills from food and utilities to rent, without falling into deeper debt, their financial anxiety is palpable.Behind much of this was a hidden factor that contributed to Trump’s victory – Federal Reserve policy.The Fed consistently portrayed itself as being able to contain inflation in these areas by raising rates, and until recently, bemoaning a “hot” labor market.In the process, the cost of debt increased and though price inflation eventually slowed, the lingering damage was done.That brings us to another vote that took place this week. The FOMC voted. Following its 50-basis point rate cut in September, the Fed cut rates by another 25-basis points, bringing us to a total of 75 points for this year. Fed Chairman Jerome Powell used the meeting to confirm what we’ve been detailing here for months. The economy isn’t doing as well as the headlines say. The Fed leader did attempt to take a slight victory lap for controlling inflation, perhaps giving cover for looming rate cuts into a labor or economic downturn.Changes to the Fed leader’s included an update noting that “labor market conditions have generally eased” while he repeated that “the unemployment rate has moved up but remains low”By all accounts, that 25-basis cut was baked in regardless of the electoral outcome.This rate-cutting path is also a sign of the Fed’s awareness that economic concerns transcend party lines. Below, we unpack what that means in the near and long term.

Three Drivers Behind the Fed’s Easing Path

Investors across the Manhattan skyline and the world financial hubs will be modeling what this Fed move, in combination with the election results, means for future cuts. Here’s what the Fed’s latest decision means for the markets, gold and silver, and for you.

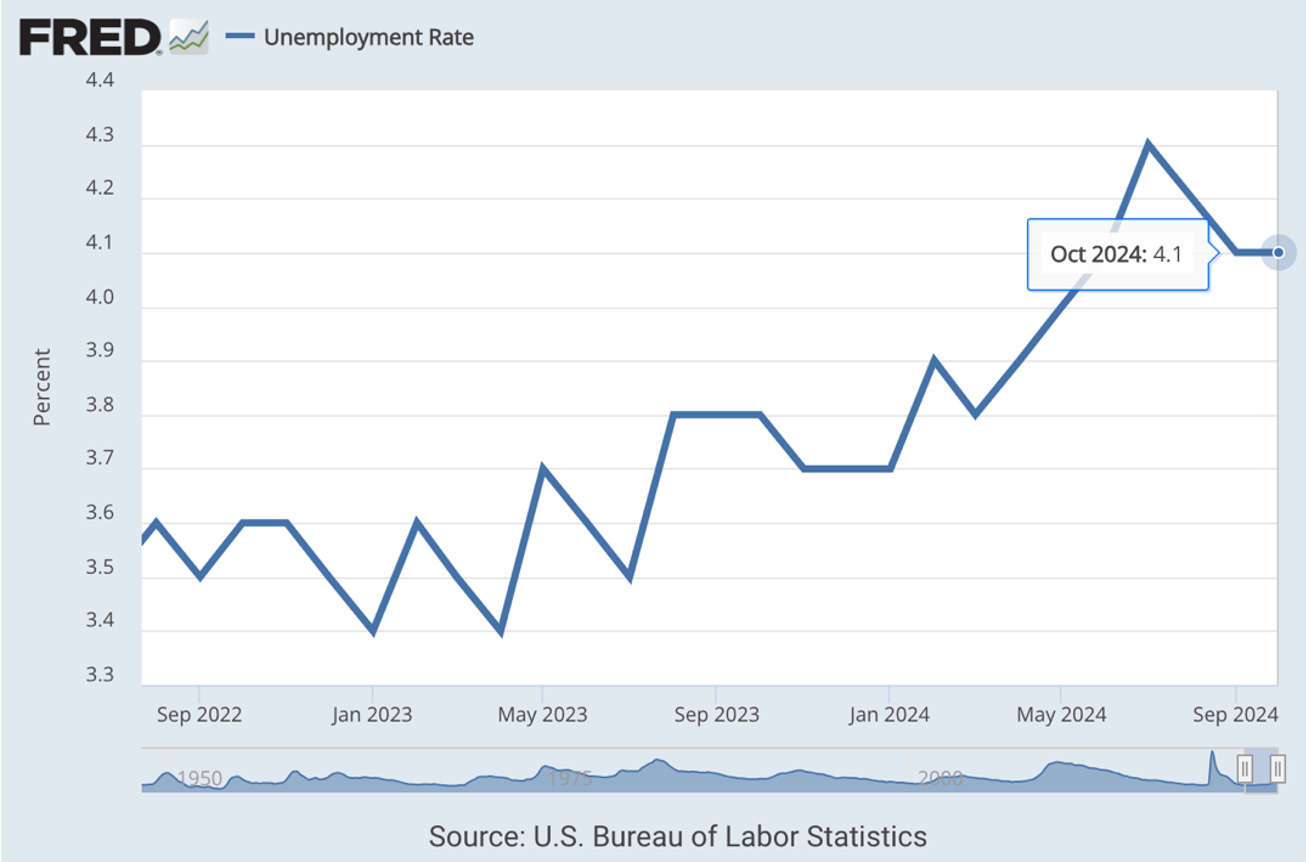

1. First, the Fed and chair Powell recognized there is weakness in the labor markets.That was evident in last week’s unchanged 4.1% . The jobless rate remains higher than in January of this year, and in the months preceding Covid. In addition, the latest report showed that a mere 12,000 jobs were created in October. That’s the lowest number since December 2020.Though some of that was attributed to fallout from hurricanes and strikes, the reality is that job creation is trending downward.Fewer available jobs imply greater anxiety for people with and without jobs. That’s especially true if wages haven’t kept up with price increases. Unfortunately, the November report is unlikely to have any material rebounds. That’s why the Fed will keep emphasizing the labor market instead of inflation in the coming months.

In addition, the latest report showed that a mere 12,000 jobs were created in October. That’s the lowest number since December 2020.Though some of that was attributed to fallout from hurricanes and strikes, the reality is that job creation is trending downward.Fewer available jobs imply greater anxiety for people with and without jobs. That’s especially true if wages haven’t kept up with price increases. Unfortunately, the November report is unlikely to have any material rebounds. That’s why the Fed will keep emphasizing the labor market instead of inflation in the coming months.

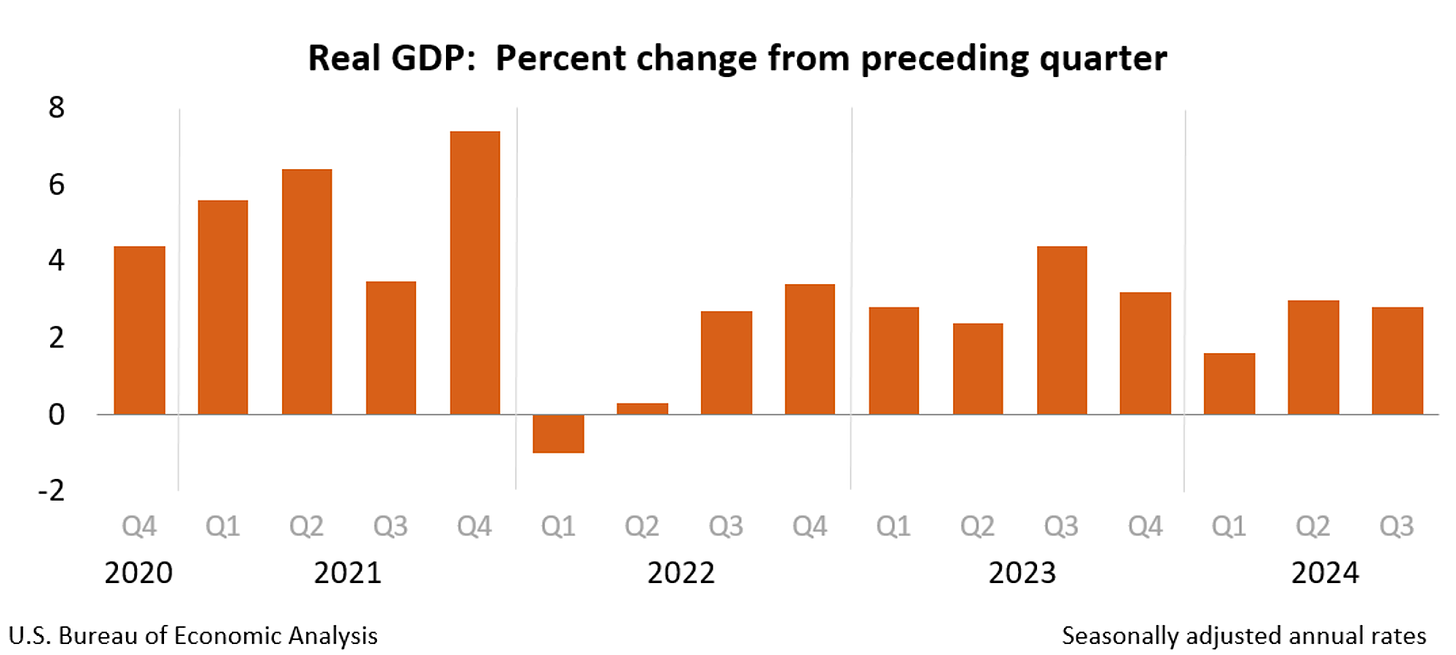

2. Second, the U.S. economy isn’t as strong as the financial headlines show.As voters across Main Street punctuated – inflation might not be getting worse, but its impact lingers.Advanced estimates show real GDP at 2.8% for Q3, which has been flatlining for three years as you can see in the chart below – with inflation to 2.1%.

Making matters worse, the U.S. economy is sustained by a growing stack of about $36 trillion in debt. Interest rate payments for that debt exceeded $1.133 trillion this year, with the Congressional Budget Office estimating that it will top $12.4 trillion over the next decade. As the U.S. debt grows, the more the U.S. government must pay to service it. That will lead to a vicious cycle of greater deficits and more debt creation to sustain the U.S. budget.The incoming Trump administration and Congress will likely cut the U.S. budget, but it won’t be enough to change the trajectory any time soon.

3. Third, this rate cut means the yield curve will continue to steepen.Yields on 30-year Treasuries are at their highest levels since July.Much of that increase centers on investor fears of future inflation and uncertainty about geo-political and supply chain reactions to higher tariffs under the Trump administration.In the future, unless central banks increase their quantitative easing programs and buy more long-bonds, they are only tweaking the cost of money at the front end of the yield curve. So, short rates will drop, while longer-rates rise in comparison.That means you’ll get less interest for your deposits, savings and money-market accounts while paying comparatively higher rates on longer-term credit items like mortgages, auto loans and credit cards.The combination of economic uncertainty, market volatility and global tensions is why some investors are stockpiling cash. This is can be highlighted by Warren Buffet’s which hit a record of $325.2 billion in cash on hand in the third quarter of the year.That cash is one form of a safe haven and wealth-preserving hedge against geo-political, financial and economic headwinds. Here’s another way you can protect yourself and even grow your wealth.

Buy Gold. Buy Silver.

The good news is that in addition to serving as a store of value, physical gold and silver offer a hedge against debt and other forms of risk and inflation.While gold may be off its recent highs, it still sits at over $2700, and could still hit our prediction of $3000 this year – while being well on its way to of $4000 next year. Silver is also on the rise and we expect that , particularly given the Elon Musk factor.As a major benefactor to the Trump campaign, Musk could impact policy decisions that benefit him. That’s why, among other industrial uses, solar energy, one key to Musk’s business (9.4% of Tesla’s came from its solar panel and energy storage business) will come into focus. Solar panels require silver. Trump has already said he supports solar.And while you might hear that banks are manipulating prices of gold and silver; we believe now is the time to consider this a buying opportunity. While Wall Street banks can and do impact markets, they can’t print gold or silver. At some point, they will have to buy underlying assets to pay off their shorting of the silver and gold trades. If this takes place, that demand will boost prices.One way to unlock associated upside is to consider the (), which is a low-cost ETF that holds physical gold and silver. More By This Author:

What Trump’s Win And Fed Decisions Mean For Gold’s Rally