Financialization results when leverage and information asymmetry replace innovation and productive investment as the source of wealth creation.

Emmanuel Saez and Thomas Piketty are leading lights in the exploration of rising wealth inequality. Both are academic economists who have devoted considerable time and effort to assembling data that deepens our understanding of the issues.

For example, Saez’s recent essay Striking it Richer: The Evolution of Top Incomes in the United States, provides an in-depth look at the widening gulf between the top 1% and the bottom 90% from 2009 to 2012.

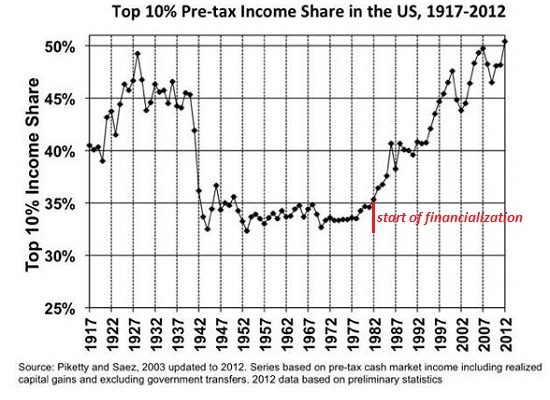

Here is a chart of the top 10% share of income, based on their research: (the note in red marking the beginning of financialization in 1982 is my own)

What is the primary driver of this era’s widening wealth inequality? Thomas Piketty’s new book Capital in the Twenty-First Century provides an answer: financialization. While definitions vary, mine is:

Financialization is the mass commodification of debt and debt-based financial instruments collaterized by previously low-risk assets, a pyramiding of risk and speculative gains that is only possible in a massive expansion of low-cost credit and leverage.

Another way to describe the same dynamics is:Â financialization results when leverage and information asymmetry replace innovation and productive investment as the source of wealth creation.

When the profits from financializing collateral and leveraging those bets to the hilt far exceed generating wealth by creating products and services, the economy is soon hollowed out as the perverse incentives of financialization start driving every business decision and strategy.

Author David Cay Johnston recently wrote an insightful review of Piketty’s book,Trickle-Up economics:

Â

Coming out of the Great Recession in 2009, inequality increased dramatically, the opposite of what happened when the Great Depression ended nearly eight decades earlier. Why?Â