Finance sector earnings were up +25% in 2018 Q1 and the expectation is that growth in the Q2 earnings season, which JPMorgan (JPM), Wells Fargo (WFC) and Citigroup (C) kick off with their results on Friday July 13, will likely be as good. But none of that shows up in the group’s stock market performance, with bank stocks one of the weakest performers in the market.

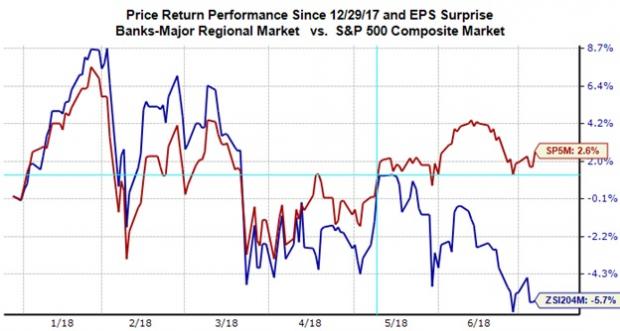

Bank stocks are down -5.7% this year, underperforming the broader market’s +2.6% gain and the Finance sector’s -4.8% decline. The group never got its mojo back after losing ground at the start of February, but continued to lead the S&P 500 through mid-March meaningfully diverging from the broader index around mid-May. The chart below shows the year-to-date performance comparison of the Zacks Major Banks industry and the S&P 500 index.

The biggest reason for this recent underperformance is the interest rate uncertainty, which has forced yields on the benchmark 10-year Treasury bond to generally move sideways and down after peaking at 3.11% in mid-May. On top of this lack of follow through in long-term yields, shorter maturity yields have been steadily going up, primarily in response to the well telegraphed Fed moves and trajectory. As a result, the yield spread between shorter maturity treasury bonds and longer maturity instruments has been steadily coming down and currently remains at its lowest level in a very long time. The chart below shows the yield spread between 2- and 10-year treasury bonds over the past year (currently at 30 basis points, as of Tuesday, July 3).

The reason we are talking about treasury yields and interest rates in a discussion about bank earnings is that Interest rates act like oxygen for banks. The low interest rates of the last few years, resulting from a deliberate Fed policy, had put a lid on banks’ earnings power. Net interest margin, the difference between what banks pay their depositors and what they charge lenders, has been flat to down for the last few years. With revenue growth hard to come by as a result of this backdrop, banks were forced to maintain profitability by squeezing expenses out of their operations.

The above chart showing yield spread between 2- and 10-treasury bonds goes to the core of the market’s dilemma about bank stocks and net interest margins and bank profitability are a function of this yield spread. The fear in the market is that banks wouldn’t benefit from Fed tightening as long-term rates remain subdued even as short-term rates have been going up.

This phenomenon, generally referred to as a ‘flattening of the yield curve’, is the reason why everyone in the market is so sour on bank stocks at present. I don’t agree with this view and see banks as one of a few areas in the market that represent genuine value. But this note isn’t about my investment outlook for banks, but rather the group’s earnings picture that starts getting clearer with Friday’s releases from JPMorgan, Wells Fargo and Citigroup. On a related note, we hold two of these three stocks in the Zacks Focus List portfolio.