Last week, at the North American Blockchain Summit in Dallas, Texas, I had the distinct privilege of moderating a fireside chat with former Canadian Prime Minister Stephen Harper.Our conversation explored how blockchain technology can strengthen the economy, increase transparency and create new investment opportunities. One standout moment was Harper’s reflection on the role the middle class plays in winning elections. In his 2018 book the prime minister urged fellow conservatives to focus on pragmatic solutions to everyday problems faced by the middle class. That was the key to winning elected office, he said.He’s absolutely right. Here in the U.S., the middle class drove much of the enthusiasm for President-elect Donald Trump and his “America First” policies. show that Trump overwhelmingly won the vote of those without a college education and those making between $30,000 and $49,000.

One standout moment was Harper’s reflection on the role the middle class plays in winning elections. In his 2018 book the prime minister urged fellow conservatives to focus on pragmatic solutions to everyday problems faced by the middle class. That was the key to winning elected office, he said.He’s absolutely right. Here in the U.S., the middle class drove much of the enthusiasm for President-elect Donald Trump and his “America First” policies. show that Trump overwhelmingly won the vote of those without a college education and those making between $30,000 and $49,000.

A Tale of Two Prime Ministers

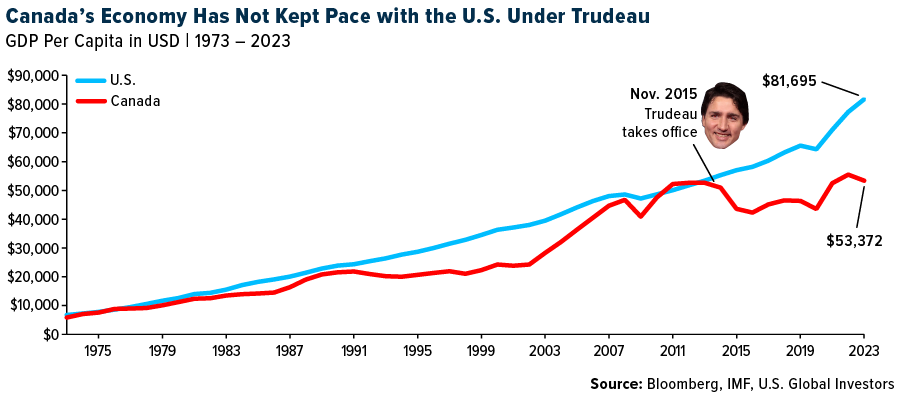

Harper also spoke of his commonsense, fiscally conservative approach to dealing with the 2008–2009 global financial crisis. Canada, believe it or not, was that fully regained and even surpassed the business investment that was lost during the recession.Unfortunately, my dear home country’s economy has struggled greatly under current Prime Minister Justin Trudeau, who has prioritized social issues over solutions to middle-class problems. During Trudeau’s administration, annual GDP-per-capita growth has Canadians are now (Click on image to enlarge)

The DOGE Initiative: Cutting Costs and Regulations

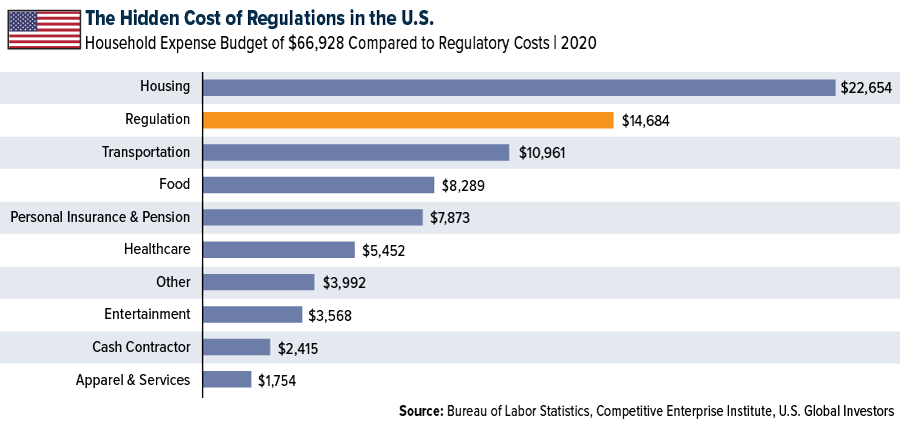

Harper’s insights tie directly into the economic anxieties felt by many working-class Americans. U.S. national debt now tops $36 trillion. Federal regulations cost approximately $2.1 trillion every year, representing around 7% of the country’s GDP, according to the Competitive Enterprise Institute (CEI).This places a significant strain on middle-class households. The CEI estimates that the average American household pays over $14,500 annually in “hidden” regulatory taxes, exceeding what they spend on nearly every other expense except housing.(Click on image to enlarge) Trump’s decision to form the Department of Government Efficiency (DOGE), co-chaired by Elon Musk and Vivek Ramaswamy, aims to alleviate this burden. In a last week, Musk and Ramaswamy described their mission to cut wasteful government spending and regulations and massively deduce headcount:

Trump’s decision to form the Department of Government Efficiency (DOGE), co-chaired by Elon Musk and Vivek Ramaswamy, aims to alleviate this burden. In a last week, Musk and Ramaswamy described their mission to cut wasteful government spending and regulations and massively deduce headcount:

“DOGE intends to work with embedded appointees in agencies to identify the minimum number of employees required at an agency for it to perform its constitutionally permissible and statutorily mandated functions.”

This reminds me of how Musk addressed runaway spending at Twitter, now rebranded as X, after he acquired the platform in April 2022. The Tesla chief reduced the company’s workforce yet X continues to operate just as well as ever.

Gold and Bitcoin

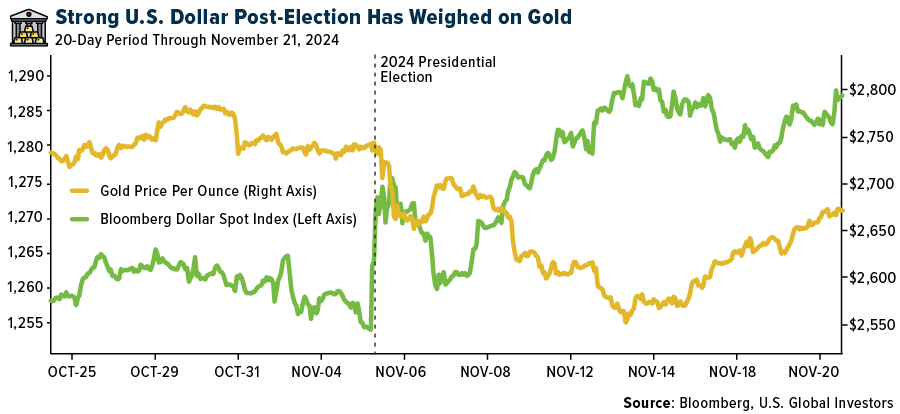

Economic uncertainty has led investors to seek safe havens. Gold has been one of the strongest-performing commodities in 2024, rising more than 31%. As you can see in the chart, the yellow metal took a hit after the election when the U.S. dollar rallied, weighing on commodities priced in the greenback.(Click on image to enlarge)

Last week, Goldman Sachs forecast that gold could reach supported by demand from central banks, geopolitical tensions and investors hedging against economic volatility.Meanwhile, Bitcoin continues to trade in the $90,000s as Trump’s promise to turn the U.S. into the world’s lights a fire under investors.Senator Cynthia Lummis’s recent proposal to has sparked debate. While Bitcoin’s potential is undeniable, I believe the U.S. would be unwise to abandon its gold, a cornerstone of financial stability for over 5,000 years. Going forward, I believe that diversification remains key, especially as geopolitical tensions support the need for safe-haven assets like gold and Bitcoin.More By This Author: