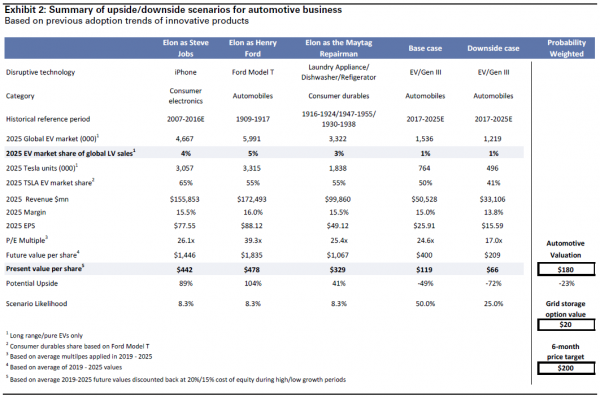

Goldman Sachs is bearish on TSLA with a $200 price target (currently trading at $236) but… provides bulls with all the hope they need to justify stock prices rising to at least $478. Laying out 5 scenarios on the company’s path to 2025, the analyst shies from his base-case and downside-risk perspective to reflect on the possibility that TSLA is truly disruptive. Depending on whether Elon Musk is Steve Jobs (iPhone projections), Henry Ford (Model T projections), or a Maytag Repairman (Consumer Durable projections), TSLA’s upside is enormous as all of our three “disruptive outcomes†imply meaningful upside to the current share price. Of course, the probability associated with each of these scenarios is why Goldman’s overall target is 15% below current prices – but that won’t stop the dreamers.

Adding rigor to the upside analysis

We quantify the option value of Tesla shares through a deep dive into the lessons learned from past disruptive technologies as well as the opportunity from stationary storage. Our new 6-month price target rises to $200.

Automotive business worth $180

If Tesla’s auto business were to be truly disruptive (to the whole auto industry, not just luxury vehicles), then there would be considerable upside.

Keying off the history of the iPhone, (adjusting for the replacement cycle) would imply 3.1mn units by 2025 and a PV of $442 per share.

The Model-T trajectory implies 3.3mn units and $478 per share;

and the volume implied by a basket of transformative durable goods (laundry appliances/dishwashers/refrigerators) gets us 1.8mn units and $329 per share.

However, this is offset by our base case (broadly unchanged from our previous forecast) and a downside case where Tesla’s present value is lower and hence we arrive at probability weighted share price of $180 for the auto business alone.

Full Goldman Sachs research note below:

Tsla Goldman