Image Source:

Image Source:

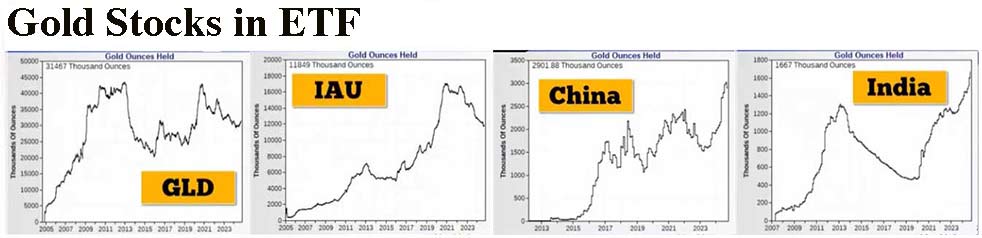

After breaking through the $2,074 resistance that held it back for four years, the seems to have been rising uninterruptedly since March.All my readers, week after week, ask me the following question: is gold about to go back down?My answer is “probably. It would be normal for it to consolidate part of its rise before going higher. It would be rather abnormal if that did not happen.”There was a slight consolidation in April, followed by another in May, then a stabilization phase in June after new all-time highs. However, the rise resumed in July and continued in August and September, with records broken each month. Amazing!How can we explain this exceptional rise in gold?On , Tass reported that from August 7 to September 5, the Russian Finance Ministry had allocated $27 million to buy gold, and from September 6 to October 4, it would allocate another $1.9 billion to acquire gold.This information could partly explain the good performance of gold in August.In addition, on August 28, Nigel Green, in the , asked: “Tectonic shift coming on global currency markets?”Chinese companies hold about $2 trillion in US assets and could repatriate a substantial portion of it, especially since the cut in key rates, announced and then implemented on September 18 by the Federal Reserve, leads to a lower return on money. Nigel Green estimates that these capital movements out of the dollar could have a significant impact on the Forex, the currency market, and cause the yuan to appreciate by about 10%.Specialist Andrew Maguire mentioned this Asia Times article in his video on , claiming that Chinese companies were generating a trillion-dollar avalanche on the gold market. By selling their dollars and presumably converting them into gold via Forex, they have contributed to the rise seen in recent weeks.It is also important to remember that China has launched a communication campaign encouraging its citizens to invest in gold and precious metals. At the same time, Chinese banks encouraged their customers to invest part of their savings in ETFs backed by the central bank. Since then, gold holdings in these Chinese ETFs have doubled, although they remain relatively low compared with reported GLD holdings: In July, from 15% to 6%.Lower prices led to a sharp increase in demand for gold and silver. In August, gold imports tripled compared to the previous month, reaching a total of $10 billion. India’s silver imports totalled 1,332 tonnes (47 Moz):

In July, from 15% to 6%.Lower prices led to a sharp increase in demand for gold and silver. In August, gold imports tripled compared to the previous month, reaching a total of $10 billion. India’s silver imports totalled 1,332 tonnes (47 Moz):

We also know that many central banks are building up their gold stocks, putting pressure on prices.Is there a link with the forthcoming BRICS meeting in Kazan at the end of October? Probably, as many analysts are expecting official announcements concerning the agenda for setting up an alternative monetary system, which would be made up of a 40% gold-backed basket of BRICS currencies.The question on everyone’s lips is: how far can gold go?All the figures have been put forward over the last 15 years, and it’s essential to remain very cautious in one’s assumptions.If we compare the period from 1999 to 2011, we can see that we have made exactly the same move as in 2008, but on a larger scale.Instead of a few months, it took 4 years. It looks like a Mandelbrot fractal.The consolidation of 2008 saw the price of gold plummet to $687, before climbing to $1,921. A multiplication of 2.79.If we reproduce the same movement in the months to come, with a low of $1,626 in 2022, gold could reach around $4,546:

Remember that when Nixon ended the Gold Standard in August 1971, gold price had a first leg of growth until January 1975, followed by a consolidation phase until September 1976. This was followed by a second leg up, during which the price rose from $104 to $850 on January 21, 1980, with a spectacular geometric increase over the last three months. So anything is possible.Gold has not finished rising.What’s remarkable is that gold is rising while silver has not yet begun to follow. The is now 1/85, which is a historical and geological aberration. During bimetallism, this ratio was fixed at 1/15, and if we consider mining resources, it should be around 1/10.On July 4, 2022, in URA magazine, Sergei Silvestrov, a scientist on the board of the Russian Security Council, stated that the Russians had developed an algorithm to evaluate a range of commodities in terms of gold. This algorithm is known as “settlement gold”.When the BRICS monetary system is established, will these countries, which are major producers of raw materials and precious metals, maintain such an absurd gold/silver ratio, or will this ratio be linked to the relative scarcity of these metals in the reserves still in the ground?Silver also has a bright future ahead.More By This Author:Europe, Heading For Inevitable Decline? Gold Boosted By Falling Interest Rates And Double Deficit-Debt Record In The U.S.France’s Deficit Under EU And Market Scrutiny

What Is Driving The Price Of Gold Up?