By Benn Steil

Harry Dexter White, the architect of the Bretton Woods international monetary system, told Congress in 1945:

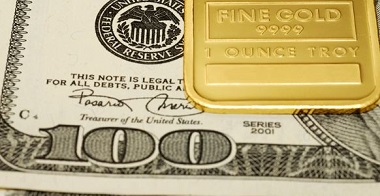

The dollar and gold are synonymous

Under the Bretton Woods system, currencies were tied to the U.S. dollar at a fixed rate, and the dollar was in turn tied to gold at $35 an ounce. Today there is much nostalgia about Bretton Woods – a belief that the quarter-century from 1946 to Aug. 15, 1971 (when the system collapsed) was a golden era of monetary stability. But the reality was very different.

Although the International Monetary Fund was inaugurated in 1946, the first nine European countries to meet the requirements of its Article VIII – that their currencies be freely convertible into dollars at a fixed rate – didn’t do so until 1961. And by then, the system was already coming under enormous strain, as the U.S. – contrary to White’s assurances – was losing gold reserves.

Under Richard Nixon, inflation climbed rapidly, reaching nearly 6% in 1970, and world dollar reserves rose sharply. In tandem, American monetary gold stocks tumbled to a mere 22% of dollars held by foreign central banks, down from 50% a few years prior.

By May 1971, Germany could no longer hold its currency peg. The deutsche mark was being driven up by relentless capital inflows as the world dumped dollars. After a bruising internal debate, the German government floated the mark on May 10. While this succeeded in curbing speculative flows into Germany, it did not halt the flow out of the U.S.

Nixon’s Treasury secretary, John Connally, angrily rejected suggestions from IMF Managing Director Pierre-Paul Schweitzer that the U.S. raise interest rates or devalue the dollar. Instead he blamed Japan, the newest destination for speculative capital in the wake of the mark’s float, for its “controlled economy“.

Dollar dumping accelerated. France sent a battleship to take home French gold from the New York Fed’s vaults.

Finally, Nixon opted for what Connally convinced him would be seen as a bold and decisive move. On Aug. 15, he went on national television to announce his New Economic Policy. In addition to tax cuts, a 90-day wage and price freeze, and a 10% import surcharge, the gold window would be closed; the U.S. would no longer redeem foreign government dollar holdings. Connally followed on by making the president’s priorities brutally clear to a group of European officials, telling them that the dollar was “our currency, but your problem“.