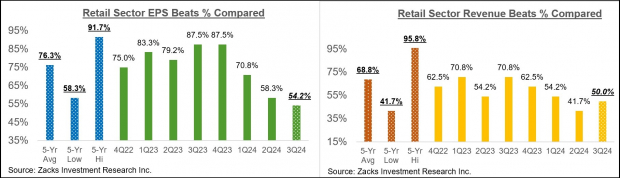

Walmart ( – ) shares have been standout performers this year, handily outperforming not just the broader market indexes and peers like Target ( – ) but also the likes of Amazon ( – ) and most of the Magnificent 7 group members.With the company on deck to report quarterly results on Tuesday, November 19th, it will be interesting if the stock can maintain its performance momentum after the results. Walmart shares were up big following the beat-and-raise quarterly results on August 15th, with the positive trend firmly in place since.The chart below spotlights Walmart’s impressive performance. The chart tracks the year-to-date performance of Walmart shares (up +60.6%) relative to the S&P 500 index (+25.1%), Amazon (+33.8%) and Target (+7.8%). Image Source: Zacks Investment ResearchIn addition to Walmart, this week also brings quarterly results from Target on Wednesday, November 20th, and Lowe’s ( – ) on Tuesday, November 19th.As with Home Depot, which has already reported better-than-expected quarterly results, Lowe’s is primarily a housing play, which has been struggling for some time now due to higher mortgage rates that have proven sticky despite the start of the Fed’s easing cycle.Demand for big home remodeling projects and other big-ticket items has remained depressed as existing home sales remain at a 20-year low. Home prices have risen nicely, but a majority of existing homeowners are financed at record-low mortgage rates, making them unwilling to replace that mortgage with a much higher level.Home Depot’s results benefited from the impact of the recent hurricanes in the Southeast, and we can reasonably expect a comparable gain from Lowe’s. Management noted that demand for discretionary big-ticket items and remodeling projects remained anemic due to the factors mentioned above.Another consumer spending that has been at play in the post-COVID period is consumers prioritizing discretionary services like travel, leisure, dining out, and hospitality. As a result of this trend, demand for discretionary goods and products, including big-ticket items like appliances, furniture, etc., has suffered.The very notable underperformance of Target shares in the first chart we shared is a direct result of this weak demand for discretionary merchandise, a product category to which Target is heavily exposed.Unlike Target, Walmart has a much heavier indexing to groceries and other ‘staply’ must-have product categories that enjoy relatively more stable demand through economic cycles. Walmart’s value orientation and well-executed digital strategy have been key to gaining grocery market share by attracting higher-income households.Walmart’s growing share of higher-income grocery spending notwithstanding, the retailer still has substantial exposure to lower-income consumers who are under a lot of financial stress due to the cumulative effects of inflation. Walmart has thus far been able to offset weakness from lower-income consumers by attracting more higher-income households through its efficient digital offerings.Walmart is expected to report $0.53 in EPS on $167.6 billion in revenues, representing year-over-year changes of +3.9% and +4.2%, respectively. Trends in Walmart’s non-grocery business have been anemic lately, though management had pointed to some early signs of stabilization in a few discretionary product categories at the last earnings call. Any signs of life on the discretionary merchandise part will also have positive read-throughs for Target.With respect to the Retail sector 2024 Q3 earnings season scorecard, we now have results from 24 of the 34 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.The Zacks Retail sector includes not only Walmart, Home Depot, and other traditional retailers but also online vendors like Amazon (AMZN Quick Quote – ) and restaurant players. The 24 Zacks Retail companies in the S&P 500 index that have reported Q3 results already belong primarily to the e-commerce and restaurant industries, though Home Depot is also included in that count.Total Q3 earnings for these 24 retailers that have reported are up +14.9% from the same period last year on +6.3% higher revenues, with 54.2% beating EPS estimates and only 50% beating revenue estimates.The comparison charts below put the Q3 beats percentages for these retailers in a historical context.

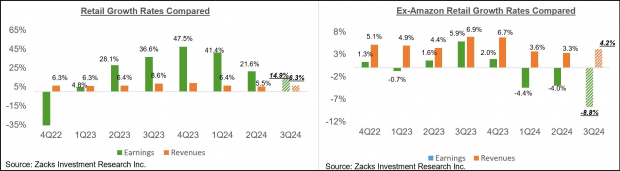

Image Source: Zacks Investment ResearchIn addition to Walmart, this week also brings quarterly results from Target on Wednesday, November 20th, and Lowe’s ( – ) on Tuesday, November 19th.As with Home Depot, which has already reported better-than-expected quarterly results, Lowe’s is primarily a housing play, which has been struggling for some time now due to higher mortgage rates that have proven sticky despite the start of the Fed’s easing cycle.Demand for big home remodeling projects and other big-ticket items has remained depressed as existing home sales remain at a 20-year low. Home prices have risen nicely, but a majority of existing homeowners are financed at record-low mortgage rates, making them unwilling to replace that mortgage with a much higher level.Home Depot’s results benefited from the impact of the recent hurricanes in the Southeast, and we can reasonably expect a comparable gain from Lowe’s. Management noted that demand for discretionary big-ticket items and remodeling projects remained anemic due to the factors mentioned above.Another consumer spending that has been at play in the post-COVID period is consumers prioritizing discretionary services like travel, leisure, dining out, and hospitality. As a result of this trend, demand for discretionary goods and products, including big-ticket items like appliances, furniture, etc., has suffered.The very notable underperformance of Target shares in the first chart we shared is a direct result of this weak demand for discretionary merchandise, a product category to which Target is heavily exposed.Unlike Target, Walmart has a much heavier indexing to groceries and other ‘staply’ must-have product categories that enjoy relatively more stable demand through economic cycles. Walmart’s value orientation and well-executed digital strategy have been key to gaining grocery market share by attracting higher-income households.Walmart’s growing share of higher-income grocery spending notwithstanding, the retailer still has substantial exposure to lower-income consumers who are under a lot of financial stress due to the cumulative effects of inflation. Walmart has thus far been able to offset weakness from lower-income consumers by attracting more higher-income households through its efficient digital offerings.Walmart is expected to report $0.53 in EPS on $167.6 billion in revenues, representing year-over-year changes of +3.9% and +4.2%, respectively. Trends in Walmart’s non-grocery business have been anemic lately, though management had pointed to some early signs of stabilization in a few discretionary product categories at the last earnings call. Any signs of life on the discretionary merchandise part will also have positive read-throughs for Target.With respect to the Retail sector 2024 Q3 earnings season scorecard, we now have results from 24 of the 34 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.The Zacks Retail sector includes not only Walmart, Home Depot, and other traditional retailers but also online vendors like Amazon (AMZN Quick Quote – ) and restaurant players. The 24 Zacks Retail companies in the S&P 500 index that have reported Q3 results already belong primarily to the e-commerce and restaurant industries, though Home Depot is also included in that count.Total Q3 earnings for these 24 retailers that have reported are up +14.9% from the same period last year on +6.3% higher revenues, with 54.2% beating EPS estimates and only 50% beating revenue estimates.The comparison charts below put the Q3 beats percentages for these retailers in a historical context. Image Source: Zacks Investment ResearchAs you can see above, the online players and restaurant operators have struggled with beating estimates in Q3, with the trend particularly notable on the EPS beats front that is tracking below the 20-quarter low at this stage.With respect to the elevated earnings growth rate at this stage, we like to show the group’s performance with and without Amazon, whose results are among the 24 companies that have reported already. As we know, Amazon’s Q3 earnings were up +71.6% on +11% higher revenues, as it beat on EPS and top- line expectations.As we all know, the digital and brick-and-mortar operators have been converging for some time now. Amazon is now a decent-sized brick-and-mortar operator after Whole Foods, and Walmart is a growing online vendor. As we noted in the context of discussing Walmart’s coming results, the retailer is steadily becoming a big advertising player, thanks to its growing digital business. This long-standing trend got a huge boost from the Covid lockdowns.The two comparison charts below show the Q3 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart).

Image Source: Zacks Investment ResearchAs you can see above, the online players and restaurant operators have struggled with beating estimates in Q3, with the trend particularly notable on the EPS beats front that is tracking below the 20-quarter low at this stage.With respect to the elevated earnings growth rate at this stage, we like to show the group’s performance with and without Amazon, whose results are among the 24 companies that have reported already. As we know, Amazon’s Q3 earnings were up +71.6% on +11% higher revenues, as it beat on EPS and top- line expectations.As we all know, the digital and brick-and-mortar operators have been converging for some time now. Amazon is now a decent-sized brick-and-mortar operator after Whole Foods, and Walmart is a growing online vendor. As we noted in the context of discussing Walmart’s coming results, the retailer is steadily becoming a big advertising player, thanks to its growing digital business. This long-standing trend got a huge boost from the Covid lockdowns.The two comparison charts below show the Q3 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart). Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Q3 Earnings Season Scorecard

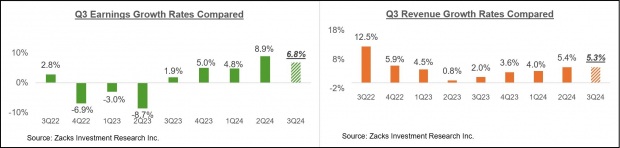

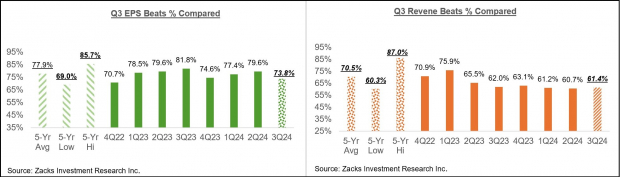

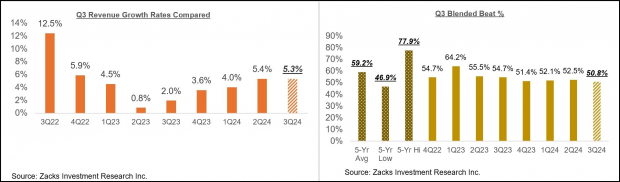

Through Friday, November 15th, we have seen Q3 results from 461 S&P 500 members, or 92.2% of the index’s total membership. We have another 14 S&P 500 members on deck to report results this week, including Nvidia, Deere & Company, and others in addition to the aforementioned retailers.Total earnings for these 461 companies that have reported are up +6.8% from the same period last year on +5.3% higher revenues, with 73.8% of the companies beating EPS estimates and 61.4% beating revenue estimates.The proportion of these 461 index members beating both EPS and revenue estimates is 50.8%.The comparison charts below put the Q3 earnings and revenue growth rates and the EPS and revenue beats percentages in a historical context. The first set of comparison charts shows the earnings and revenue growth rates. Image Source: Zacks Investment ResearchThe second set of comparison charts compares the Q3 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment ResearchThe second set of comparison charts compares the Q3 EPS and revenue beats percentages in a historical context. Image Source: Zacks Investment ResearchThe comparison charts below spotlight the revenue performance and the blended beats percentage for this group of 461 index members.

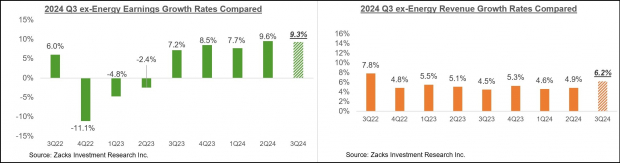

Image Source: Zacks Investment ResearchThe comparison charts below spotlight the revenue performance and the blended beats percentage for this group of 461 index members. Image Source: Zacks Investment ResearchPlease note that Q3 earnings growth has been held down by the weak growth rate in the Energy sector. Excluding the Energy sector drag, Q3 earnings growth for the rest of the index would be +9.3% (vs. +6.8% as a whole).The chart below compares the ex-Energy growth earnings and revenue growth rates in Q3 relative to other recent periods.

Image Source: Zacks Investment ResearchPlease note that Q3 earnings growth has been held down by the weak growth rate in the Energy sector. Excluding the Energy sector drag, Q3 earnings growth for the rest of the index would be +9.3% (vs. +6.8% as a whole).The chart below compares the ex-Energy growth earnings and revenue growth rates in Q3 relative to other recent periods. Image Source: Zacks Investment ResearchAs you can see above, the growth trend appears stable-to-positive, though fewer companies have beat consensus estimates relative to other recent periods. In fact, both the EPS and revenue beats percentages are tracking below the 20-quarter averages.

Image Source: Zacks Investment ResearchAs you can see above, the growth trend appears stable-to-positive, though fewer companies have beat consensus estimates relative to other recent periods. In fact, both the EPS and revenue beats percentages are tracking below the 20-quarter averages.

The Earnings Big Picture

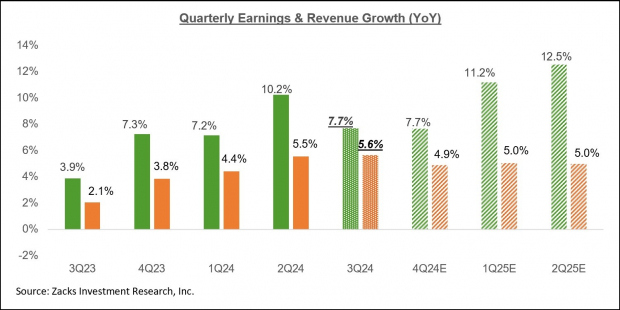

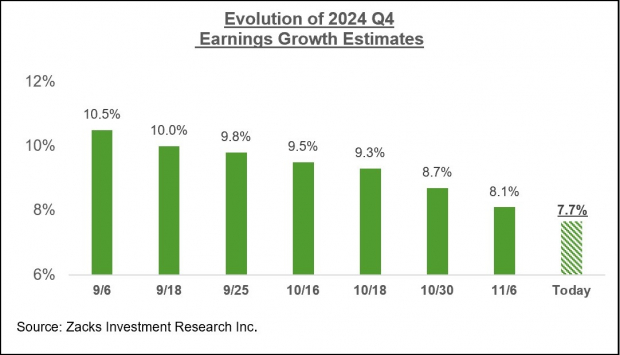

Looking at Q3 as a whole, combining the results that have come out with estimates for the still-to-come companies, total earnings for the S&P 500 index are expected to be up +7.7% from the same period last year on +5.6% higher revenues.The chart below shows the Q3 earnings and revenue growth pace in the context of where growth has been in the preceding four quarters and what is expected in the coming three quarters. Image Source: Zacks Investment ResearchThe Energy and Tech sectors are having the opposite effects on the Q3 earnings growth pace, with the Energy sector dragging it down and the Tech sector pushing it higher.Had it not been for the Energy sector drag, Q3 earnings for the S&P 500 index would be up +10.1% instead of +7.7%. Excluding the Tech sector’s substantial contribution, Q3 earnings growth for the rest of the index would be up only +2.9% instead of +7.7%.Excluding the contribution from the Mag 7 group, Q3 earnings for the rest of the 493 S&P 500 members would be up only +2.3% instead of +7.4%.For the last quarter of the year (2024 Q4), total S&P 500 earnings are expected to be up +7.7% from the same period last year on +4.9% higher revenues.Unlike the unusually high magnitude of estimate cuts that we had seen ahead of the start of the Q3 earnings season, estimates for Q4 are holding up a lot better, as the chart below shows.

Image Source: Zacks Investment ResearchThe Energy and Tech sectors are having the opposite effects on the Q3 earnings growth pace, with the Energy sector dragging it down and the Tech sector pushing it higher.Had it not been for the Energy sector drag, Q3 earnings for the S&P 500 index would be up +10.1% instead of +7.7%. Excluding the Tech sector’s substantial contribution, Q3 earnings growth for the rest of the index would be up only +2.9% instead of +7.7%.Excluding the contribution from the Mag 7 group, Q3 earnings for the rest of the 493 S&P 500 members would be up only +2.3% instead of +7.4%.For the last quarter of the year (2024 Q4), total S&P 500 earnings are expected to be up +7.7% from the same period last year on +4.9% higher revenues.Unlike the unusually high magnitude of estimate cuts that we had seen ahead of the start of the Q3 earnings season, estimates for Q4 are holding up a lot better, as the chart below shows. Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on a calendar-year basis, with the +7.9% earnings growth this year followed by double-digit gains in 2025 and 2026.

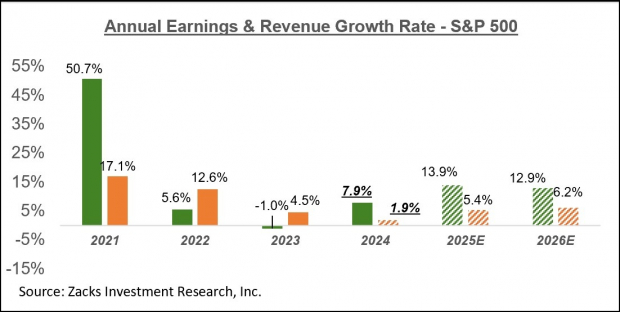

Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on a calendar-year basis, with the +7.9% earnings growth this year followed by double-digit gains in 2025 and 2026. Image Source: Zacks Investment ResearchPlease note that this year’s +7.9% earnings growth improves to +9.8% on an ex-Energy basis.More By This Author:

Image Source: Zacks Investment ResearchPlease note that this year’s +7.9% earnings growth improves to +9.8% on an ex-Energy basis.More By This Author:

What Can Investors Expect From Retail Earnings?