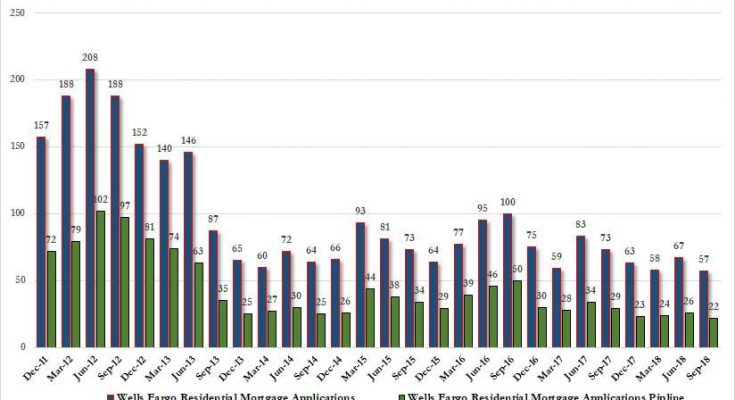

When we reported Wells Fargo’s Q1 earnings back in April, we drew readers’ attention to one specific line of business, the one we dubbed the bank’s “bread and butter“, namely mortgage lending, and which as we then reported was “the biggest alarm” because “as a result of rising rates, Wells’ residential mortgage applications and pipelines both tumbled, sliding just shy of the post-crisis lows recorded in late 2013.

Then, a quarter ago a glimmer of hope emerged for the America’s largest traditional mortgage lender (which has since lost the top spot to alternative mortgage originators), as both mortgage applications and the pipeline posted a surprising, if welcome to bulls, rebound.

However, it was not meant to last, because buried deep in its presentation accompanying otherwise unremarkable Q3 results (modest EPS and revenue beats), Wells just reported that its ‘bread and butter’ is once again missing, and in Q3 2018 the amount in the all-important Wells Fargo Mortgage Application pipeline shrank again, dropping to $22 billion, the lowest level since the financial crisis.

Yet while the mortgage pipeline has not been worse in a decade despite the so-called recovery, at least it has bottomed. What was more troubling is that it was Wells’ actual mortgage applications, a forward-looking indicator on the state of the broader housing market and how it is impacted by rising rates, that was even more dire, slumping from $67BN in Q2 to $57BN in Q3, down 22% Y/Y and the lowest since the financial crisis (incidentally, a topic we covered recently in “Mortgage Refis Tumble To Lowest Since The Financial Crisis, Leaving Banks Scrambling”).

Meanwhile, Wells’ mortgage originations number, which usually trails the pipeline by 3-4 quarters, was nearly as bad, dropping $4BN sequentially from $50 billion to just $46 billion. And since this number lags the mortgage applications, we expect it to continue posting fresh post-crisis lows in the coming quarter especially if rates continue to rise.