Believe it or not, the S&P 500 (SPX) (SPY) lost ground last week. It was a “just barely” situation, and the Russell 2000 (RUT) (IWM) as well as the NASDAQ Composite (COMP) (QQQ) both ended the week higher even with Friday’s pullbacks. The across-the-board weakness to close out the week, however, is something to think about even if it’s not yet something to worry about.

The odds are weighed below. Let’s first dissect last week’s economic numbers and preview what’s coming up this week.Â

Economic Data

It was a busy week last week from start to finish on terms of economic news. We’ll stick with the highlights and keep the discussion to a minimum. Charts do most of the talking anyway. In no particular order…

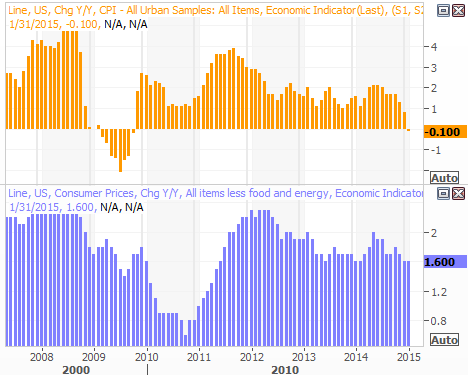

Odds are good you’ve heard the United States is now experiencing deflation; the annualized inflation rate now stands at -0.09%. The pullback in oil prices, and therefore gasoline prices is the culprit, but even on a core basis (not counting food and energy) inflation is quite low.Â

Inflation Trends Chart

Source:Â Thomson Reuters Eikon

Though consumers aren’t feeling quite as good as they did a month ago, in the grand scheme of things they’re still feeling optimistic. Though both the Michigan Sentiment Index and the Conference Board’s consumer confidence levels pulled back a little in February, both are still near long-term highs created by a firm uptrend.

Consumer Sentiment Trends Chart

Source: Thomson Reuters Eikon

Home sales were off slightly in January. Sales of existing homes slipped from a December pace of 5.07 million to 4.82 million, below expectations of 4.95 million. New home sales of an annualized pace of 481,000 was down a bit from December’s 482,000 pace, but better than the expected 470,000 units.

Finally, though home sales were a little anemic, prices at which those homes are being sold continue to rise. Both the Case-Shiller 20-city Index and the FHFA Housing Price Index (seasonally adjusted in both cases) were up in December, extending already well-established uptrends.Â