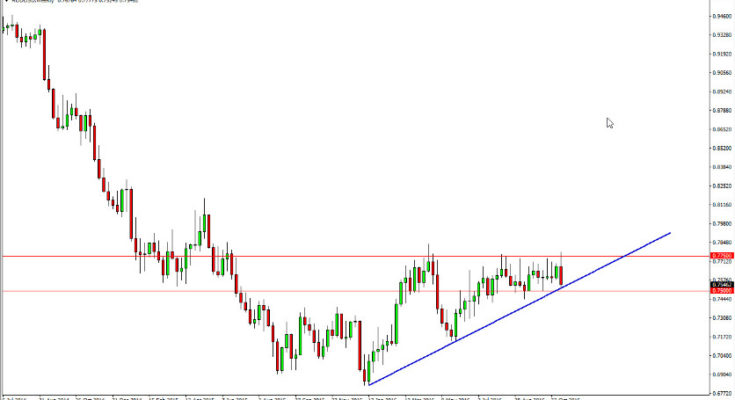

AUD/USD

The Australian dollar tried to rally initially, but as you can see the 0.7750 level above cause quite a bit of resistance. At the end of the day on Friday, we found ourselves testing the uptrend line, and more importantly the 0.75 level just below there. If we break down below that handle, I believe that we will start to roll over in the Aussie and reach towards the 0.70 level given enough time. This week will be vital, because we do bounce or we break down.

USD/JPY

This is a very volatile week for the pair, which of course wasn’t a surprise after the shock election results of Donald Trump winning the presidency. However, what I would say is that on the daily charts this looks to keep very strong market suddenly, and I believe that pullbacks will be looked at as potential buying opportunities. I have no interest whatsoever in shorting this market as the US dollar appears to be King.

GBP/USD

The British pound fell initially during the week but did see a bit of strength. This is going to be a very difficult market to deal with, because we formed a shooting star on Friday showing that we are getting a bit exhausted. If we can break above that candle, I feel that the British pound will probably try to reach towards the resistance barrier at the 1.2850 handle. A break down below the 1.25 handle has this market selling off, but either way I’m not looking for drastic moves.

EUR/USD

The Euro had an extraordinarily volatile week. As a result, we ended up forming a very negative candle and I believe that it is only a matter of time before we break down below the 1.08 handle. Once we do, I think that we reach towards the 1.05 level. I look at any rally at this point in time as a nice selling opportunity based upon “value†in the US dollar.

Â