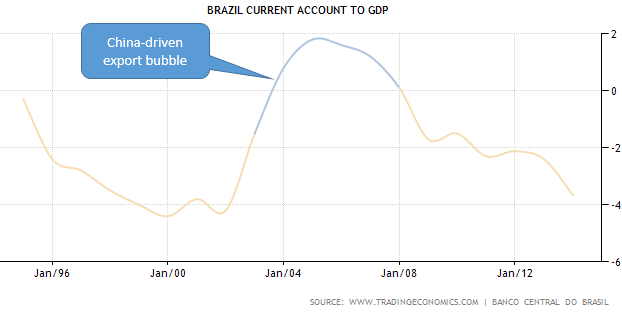

Staying with the South America theme, we are seeing signs of economic troubles in Brazil. To be sure, the nation is still an economic powerhouse – the 7th largest economy in the world. Yet the end of the China-driven commodity supercycle has created significant headwinds for Brazil’s economic growth.

Here are some key indicators economists are watching for signs of further deterioration:

1. In recent months industrial production has been declining at the fastest rate since 2009.

2. The labor markets remain under pressure, resulting in declines in consumer confidence.

|

| Source: Reuters |

3. While the consolidated public sector accounts (including state-owned enterprises) remain in the black, the surplus levels continue to shrink. Fiscal deterioration remains a major risk.

|

| Source: Credit Suisse |

4. Even though the nation’s banking system has been relatively sound, credit extended by banks to the housing sector has exploded in over the last 5 years. If the economy stumbles, this could become an issue.

| Brazil Bank Credit To Housing |

|

|

ith economists now projecting Brazil’s GDP growth of just 0.79% for 2014 and the national elections approaching, the central bank is injecting new liquidity into the banking system. As usual, central bankers are asked to solve what amounts to structural problems – which they try to address with the only tools they have.

FT: – Brazil has made its second multibillion-dollar injection into the banking system in less than a month as the government struggles to boost the economy ahead of hotly contested presidential elections.

The central bank on Wednesday eased rules on reserve requirements, freeing up about R$10bn ($4.5bn) for new lending. Just over three weeks ago, it injected R$45bn into the economy by easing compulsory deposit rules and changing the risk calculation of some loans.