Data/Event Risks

Data/Event Risks

- USD: Veteran’s day holiday, so trading will be very subdued.

- EUR: Finance ministers meet in Brussels later today and although this does bring event risk, it’s not major given that most of the disappointment with regards to Greece and also Spain has been factored into the price.

Idea of the Day

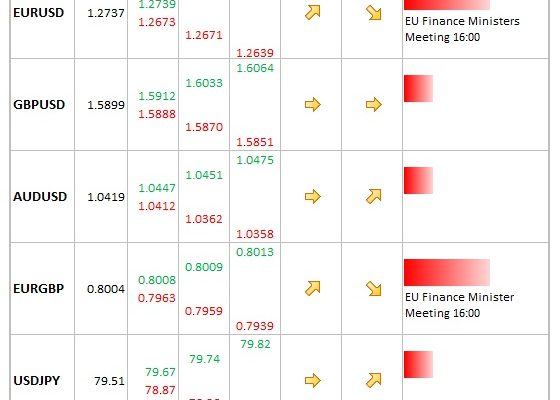

Last week was notable for better signs of breakouts from recent ranges and this brings in key levels to watch today. On EUR/USD, levels not seen since the ECB announcement early Sept. on its revised bond buying program are being tested. The 1.2671 level is key trendline support from here. For now, it looks like this should remain safe, but after this week’s finance minister’s meeting, we are unlikely to get fresh policy impetus in Europe and the much maligned approach of ‘muddling through will take over. Meanwhile, the boost from the Sept. ECB announcement will continue to fade as Spain remains reluctant to ask for assistance. This is not a credible solution longer-term.

Latest FX News

- JPY: The fall in Q3 GDP was in line with expectations at -0.9% QoQ. Data showed economy fairly weak in most sectors, with Nikkei down nearly 1% and yen holding steady around 79.50.

- AUD: Data overnight showed home loans rising 0.9% MoM, broadly in line with expectations. Lending trend has been improving recently. AUD modestly bid, up to 1.0420 area in Asia.

- EUR: The Greek parliament approved the 2013 budget over the weekend. This paves way for next loan tranche payment, although this is not likely to happen this week. EUR/USD drifted slightly higher through Asia session towards 1.2730.

- CNY: Data on new loads were softer in Oct, down 14% vs. last October. Govt has been pushing more lending so data is modest disappointment. But trade data out on Saturday was stronger, showing exports rising 9.9% YoY.