Bank stocks have been on fire since the election. Wells Fargo (WFC), one of the biggest banks in the U.S., is up 18% since November 8th. There has been a remarkable shift in investor sentiment in just the past six months.

For most of 2016, Wells Fargo investors faced the unfolding fake accounts scandal, tightening regulations, and weak growth stemming from low interest rates. But in the aftermath of the election, things are looking up for Wells Fargo shareholders.

One of the company’s biggest investors is Warren Buffett, Chairman and CEO of Berkshire Hathaway (BRK-A) (BRK-B). Berkshire owns 479.7 million shares of Wells Fargo, worth approximately $26.70 billion. (To see the complete list of all 47 stocks in Warren Buffett’s portfolio, click here.)

Investor hopes are buoyed by the prospect of a much friendlier regulatory environment, and a compelling growth catalyst in the form of rising interest rates. This article will discuss why Wells Fargo is a classic Buffett stock, with a positive outlook going forward.

Business Overview

Wells Fargo is the nation’s third-largest U.S. bank by assets. It was founded all the way back in 1852. This is a more difficult period for Wells Fargo than usual, due to the company’s fake accounts scandal. Wells Fargo incurred a $185 million fine, because it opened millions of accounts for its customers without their consent.

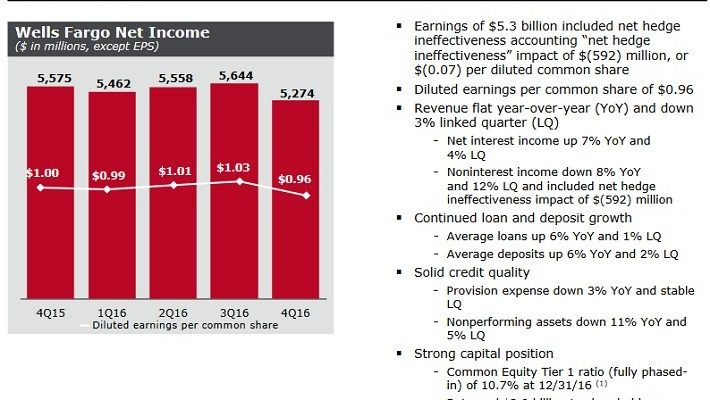

It eventually cost the CEO his job, and cast a cloud of uncertainty over the company for most of 2016. While Wells Fargo’s full-year revenue increased 2.6%, its earnings-per-share declined 3.2%, to $3.99. The results deteriorated as the year progressed. Earnings-per-share declined 7% in the fourth quarter.

Source:Â 2016, page 8

The good news is, Wells Fargo’s financial performance held up well. The company remained highly profitable in 2016, which is a testament to its competitive advantages. This allowed the company to continue investing in the business and buying back stock, which helped keep earnings afloat.