W.P. Carey (WPC) stock has declined 15% from its 52-week high, set back in June 2016. At the same time, the company has consistently increased its dividend for several years, resulting in a current dividend yield exceeding 6%.

Its 6.4% dividend yield is highly appealing, relative to the alternatives. Such a high yield is rare, in light of persistently low interest rates.

You can see the full list of established 5%+ yielding stocks by clicking here.

Consider that the average dividend yield in the S&P 500 Index is roughly 2%, and the yield on the 10-year U.S. Treasury Bond is just 2.34%. Not only does W.P. Carey offer a very high yield, it also provides investors with regular dividend growth. W.P. Carey is a Dividend Achiever, a group of 264 stocks with 10+ years of consecutive dividend increases. You can see the full Dividend Achievers List here. This article will discuss why its high yield and annual dividend growth make W.P. Carey stock attractive as an income investment.

Business Overview

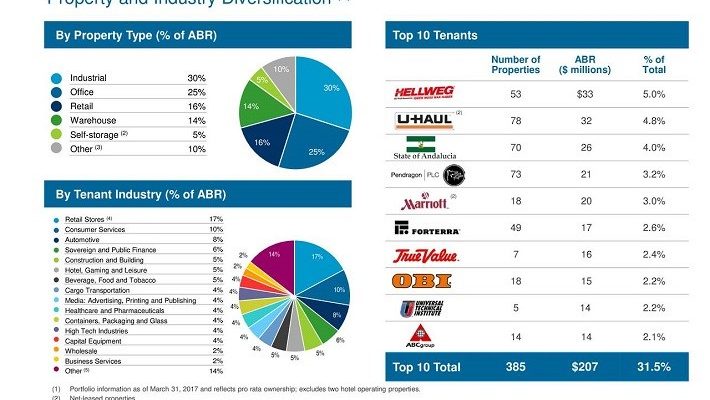

W.P. Carey is a Real Estate Investment Trust, also known as a REIT. It has a market capitalization of approximately $6.7 billion, and an enterprise value of $10.7 billion. It invests in commercial real estate, under the sale-leaseback model. This is when a tenant sells a property to a REIT, which then leases it back to the tenant. As of March 31, 2017, the company owned 900 net-lease properties with 214 tenants. It has long-term agreements with high-quality tenants. W.P. Carey’s portfolio has an average remaining lease term of 9.6 years. The portfolio has 99.1% occupancy.

Source:Â Q1 Earnings Presentation, page 11

The company has a diversified property portfolio, both in terms of industry and geography. Approximately 67% of its annual rent is derived from the U.S., with 28% from Europe and the remainder from various international markets including Mexico, Canada, Japan, and Australia. Among W.P. Carey’s top tenants are several strong companies with leadership positions in their respective industries. This has provided the company with steady growth. W.P. Carey generated funds from operation, or FFO, of $547.7 million in 2016. FFO-per-share was $5.12, an increase of 2.6% from the previous year. Growth was driven by cost controls, as well as 2.4% growth in net revenue from owned real estate. These catalysts should continue to fuel growth in 2017 and beyond.