On the day voting for the UK referendum finally began, what started off as a trading session with a modest upward bias, promptly turned into a buying orgy in painfully illiquid markets shortly after Europe opened as an influx of buy orders pushed European stocks 2% higher, propelled by cable which was above 1.49 for the first time since December and USDJPY climbing over 1.05 in sympathy, following the release of the final Ipsos Mori poll which showed Remain at 52% to 48% for leave.

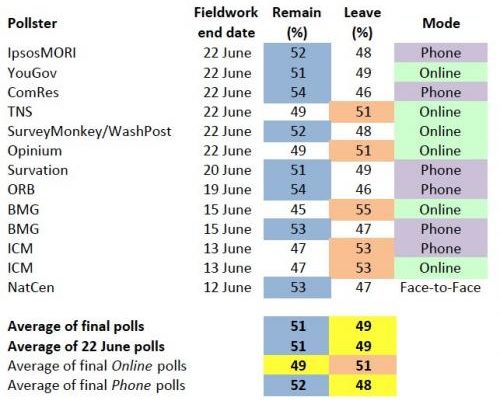

The final poll breakdown is as follows, and shows a lead for Remain based on phone polls and a slight lead for Leave from online polls.

One look at the chart of cable shows that as far as the FX market is concerned at least the outcome is now sealed.

Then again, with all polls largely in the margin of error, predicting a victory for Remain may be premature: ““Some cash is returning to markets, but I would rather stay put until the results. You can’t really rule anything out before tomorrow,â€Â said Thomas Thygesen, SEB AB’s head of cross-asset strategy in Copenhagen. “The issue will be how the outcome is perceived and how the biggest stakeholders react. Even just the absence of bad news may be the start of a risk rally, and markets have been rising in the anticipation of this.

The MSCI All-Country World Index hit a two-week high, rising 0.7% in early trading, with above-average trading in shares on Europe’s benchmark, amid a vote that past opinion polls indicated was too close to call. A gauge of sterling advanced for a second day, while a measure of implied overnight price swings versus the dollar climbed to a record. The U.S. currency weakened versus all of its major peers except the yen. The Mexican peso and Russia’s ruble led gains among oil-exporting nations as crude advanced. The cost of insuring high-yield corporate debt against default fell for a fifth day, the longest run since April. U.S. Treasuries dropped as Spanish and Italian notes rose.

Needless to say, investors have been glued to the U.K.’s debate on EU membership in recent weeks as governments and central banks around the world warned that a vote for a so-called Brexit could hurt global economic growth and destabilize financial markets. As Bloomberg writes, a gauge of expected volatility in U.S. stocks jumped to its highest level since February ahead of the referendum.

The Stoxx Europe 600 Index also rose for a fifth day, surging 1.3 percent, with miners leading a rally of all industry groups. The volume of shares changing hands on the European index was about 29 percent higher than the 30-day average. Britain’s benchmark FTSE 100 Index advanced 1.2 percent. Voters have until 10 p.m. to cast their ballot in the referendum on EU membership. The first results are expected around midnight, while the final ones are due at about 7 a.m. on Friday. Polls published over the last three days suggested the vote will be finely balanced between the two camps. Futures on the S&P 500 added 1.1 percent and were flirting with the 2,100 level.

Aside from the Brexit vote, investors will also look data on jobless claims, manufacturing and new home sales for indications of the health of the world’s biggest economy and the possible trajectory of interest rates.

Market Snapshot

- S&P 500 futures up 0.9% to 2097

- Stoxx 50 up 2.0% to 33036

- FTSE 100 up 1.6%.35 to 6358

- DAX up 1.9% to 10261

- German 10Yr yield down less than 1bp to 0.06%

- Italian 10Yr yield down 3bps to 1.41%

- Spanish 10Yr yield down 2bps to 1.48%

- S&P GSCI Index up 0.2% to 377.6

- MSCI Asia Pacific up 0.8% to 131

- Nikkei 225 up 1.1% to 16238

- Hang Seng up 0.4% to 20868

- Shanghai Composite down 0.5% to 2892

- S&P/ASX 200 up 0.2% to 5281

- US 10-yr yield up 2bps to 1.71%

- Dollar Index down 0.34% to 93.4

- WTI Crude futures up 0.5% to $49.38

- Brent Futures up 0.6% to $50.20

- Gold spot up 0.3% to $1,270

- Silver spot up 0.9% to $17.43

Top Global News

- Final Brexit Appeals Made as Polls Diverge on Referendum’s Eve: ComRes survey late Wednesday shows Remain ahead, boosts GBP

- Pound’s Day of Destiny Arrives as History Shows What’s Possible: Liquidity biggest problem after a leave vote: Insight

- VW Owners Split for First Time on Diesel Scandal in AGM Vote: Lower Saxony abstains from ratifying executives’ actions

- House Republicans Leave Town as Democrats Extend Gun Sit-In: Democrats say protest will continue until votes are scheduled

- Mylan Says Indian Drug Industry Needs More Transparency From FDA: Mylan has ‘moved on’ from Perrigo bid, President Malik says

- Caesars Creditors to Vote on Plan, But Confirmation Fight Awaits: Company still seeking deal to avoid risky court battle

- Twilio Raises $150m Pricing IPO Above Marketed Range: San Francisco-based company priced 10m Class A shares at $15 each

- BofA Said in Talks to Settle With SEC for $400m-$450m: WSJ: Settlement may be announced as soon as Thursday

- China’s Sanpower Says It Joins Bids for McDonald’s China Rights: Sanpower submitted joint bid with Beijing Tourism Group

* * *

Looking at regional markets, Asia stocks traded mixed as all focus remained on today’s UK referendum. Nikkei 225 (+1.1%) and ASX 200 (+0.2%) were supported at the open, alongside gains in US equity futures after the release of Comres and YouGov polls which showed the Remain campaign jumped ahead. However, gains were capped as cautiousness still persisted and as Chinese markets entered the fray, with the Shanghai Comp (-0.3%) negative on continued debt concerns and after the PBoC reduced the size of its liquidity injections. Finally, 10yr JGBs were pressured as the risk-on sentiment in Japan restricted flows into the safe-haven, although prices were lifted off worst levels following a 20yr bond auction with had a better than prior b/c.