“Slouch” is very descriptive word. As a noun “stand, move, or sit in a lazy, drooping way”, and as a verb it is “a lazy, drooping posture or movement”. (It also rhymes with “couch”, a preferred locale for many a slouch). At present, I can’t think of a better way to describe stock market volatility.The slouching volatility is reflected in the relatively low level of , the Cboe Volatility Index. As I write this, it has slipped below 14. That is a notable drop from the levels that prevailed from late October through early this month, but also well above its 10.67 low on July 19th.

VIX, 6-Months Daily Candles (top), MACD (12,2 6,9, bottom)

(Click on image to enlarge) Source: Interactive Brokers (using the new advanced charting feature)

Source: Interactive Brokers (using the new advanced charting feature)

While some commentators have viewed this as a signal that the low level of VIX reflects complacency, I don’t fully subscribe to that notion. ,

VIX is not a fear gauge. It just plays one on TV…

This is because VIX is “market expectations of near-term volatility conveyed by S&P Index () options prices”. The definition makes no mention of fear.Investors tend to expect higher volatility when they are fearful and less when they are sanguine.The former often results in turbulence; the latter in modest, more predictable moves. Since the VIX calculation utilizes SPX options with 23-37 days until expiration, it made sense for VIX to rise ahead of the election.It was reasonable to expect volatility arising from the election results.And we did in fact get volatility – “.” Remember, volatility is agnostic – it measures the absolute value of the percentage moves, regardless of direction.Thus, the rallies from Tuesday-Thursday of last week, +1.23%, +2.53%, and +0.74% were indeed the sort of outsize moves that the 20-ish VIX reading anticipated. It is also normal for traders to expect volatility to diminish when a major anticipated event is in the rear-view mirror.There is simply nothing on the immediate horizon that one could expect to offer the sort of volatility that one might expect from a Presidential election.We see VIX tend to diminish after a key economic event or FOMC meeting, and we certainly see individual stocks’ implied volatilities decline after an earnings report.Currently SPX has seemingly gone to sleep, with the past four days offering moves of +0.38%, +0.10%, -0.29%, and +0.02%.With no major events coming soon and SPX engaging in the struggle that major indices often face when trying to breach a major psychological level (like SPX 6,000), it is not surprising that traders have diminished their volatility assumptions.The VIX decline makes sense when we think about it that way.We can see that the 10-day historical volatility for SPX has begun to drop off, and it is reasonable to expect it to drop further if the market remains stable as the post-election volatility is removed from the calculation.

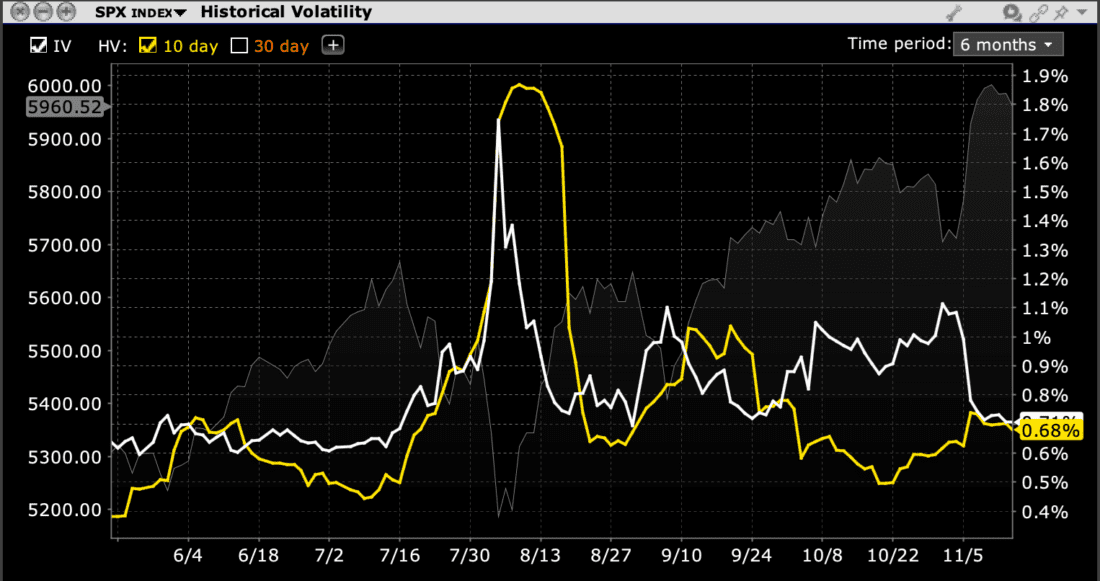

SPX, 6-Months, 10-Day Historical Volatility (yellow), Implied Volatility (white)

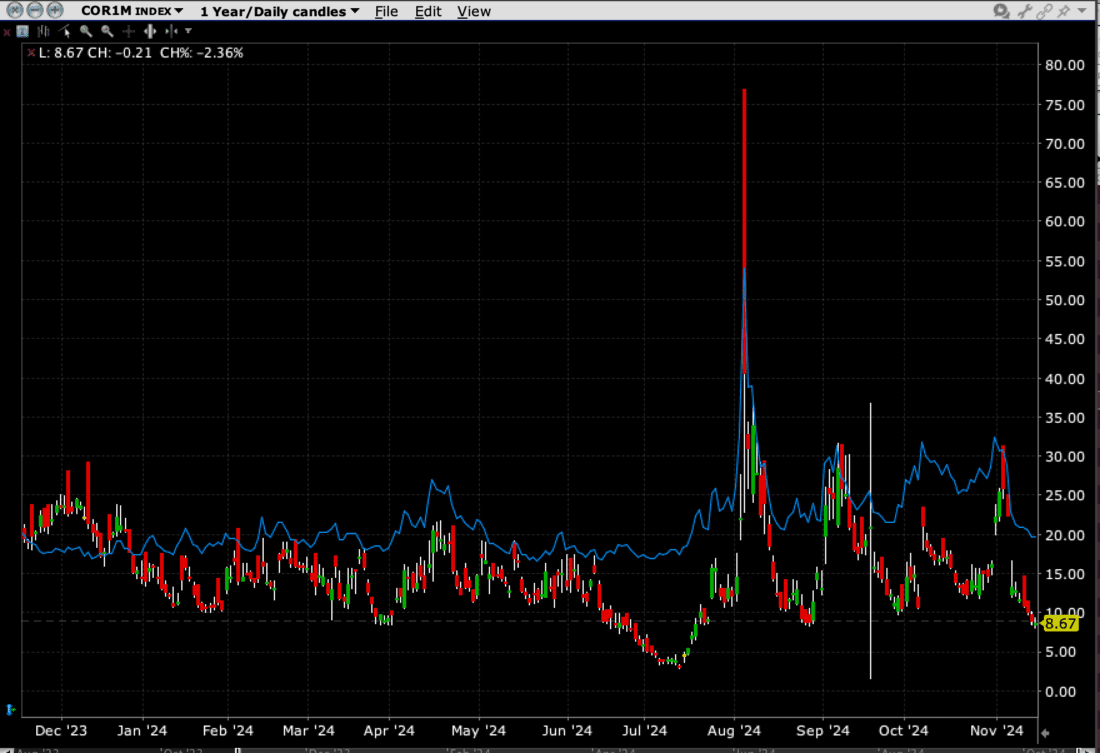

(Click on image to enlarge) Source: Interactive BrokersAnother factor weighing upon VIX is the lack of correlation between key stocks.It is a good thing to see the markets broaden their focus away from a select group of market leaders, but that means that stocks within the index are moving in different directions.Even on the best days last week we saw advances lead decliners by roughly 2:1 or 3:2. That implies decorrelation, and that adversely affects VIX.(Much more about the )

Source: Interactive BrokersAnother factor weighing upon VIX is the lack of correlation between key stocks.It is a good thing to see the markets broaden their focus away from a select group of market leaders, but that means that stocks within the index are moving in different directions.Even on the best days last week we saw advances lead decliners by roughly 2:1 or 3:2. That implies decorrelation, and that adversely affects VIX.(Much more about the )

1-Year, VIX (blue) vs. COR1M Index (red/green)

(Click on image to enlarge) Source: Interactive Brokers

Source: Interactive Brokers

So, volatility has been indeed a slouch. And to end with a laugh, I’ll quote one of my favorite from the movie “”:Judge Smails: You know, you should play with Dr. Beeper and myself. I mean, he’s been club champion for three years running, and I’m no slouch myself.Ty Webb: Don’t sell yourself, short Judge, you’re a tremendous slouch.More By This Author: