For once, Mario Draghi was right.

A day after the European central bank head warned of a spike in volatility, volatility did just that. Only it wasn’t just the German Bund, which as we previously noted suffered its biggest two day drop since the 1990s – this time it was China, whose Shenzhen index is where Bill Gross said in a tweet would be the next “short of a lifetime (in a tweet)”.

And sure enough, just a few hours later, the Shenzhen suffered its biggest crash in more than two years, plunging 6.2%, with the Shanghai Composite also tumbling 5.35%. The catalyst: much as Gross would like to take credit wasn’t the Bond King in absentia, but a local broker, Golden Sun, whichannounced shortly after the start of trading that it would suspend margin purchases of shares on Shenzhen’s startup board, ChiNext. A drop, incidentally, which brought the YTD gain on the ChinExt to just over 100%.

Promptly the concerns about a long-overdue market crash emerged: “The market has seen strong gains and sentiment is turning cautious with investors worrying if the index will repeat the correction seen years ago,†Shenwan Hongyuan analyst Qian Qimin told Bloomberg “It’s a market built purely on sentiment, and once that sentiment changes, people will follow suit to take profit. Bocom’s Hong Hao added that “Once the selling starts, it will ripple through the market especially in a highly leveraged environment.”

And then, just as suddenly as the selling started, it stopped. Not only did it stop, but a furious wave of buying in the closing hours wiped out the entire 6% loss, and the Shenzhen closed barely unchanged, down just 0.6%. The move on the Composite was even more unprecedented: following the 5.35% slump, the exchange actually closed up 0.8%, with bubble mania volatility reminiscent of what happened to bitcoin at its peak.

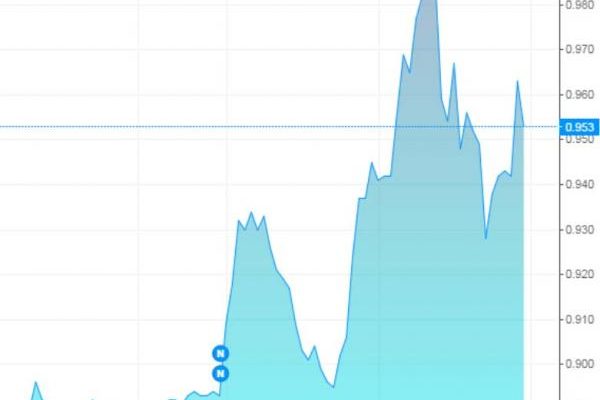

Then Europe opened, and as if continuing on the negative sentiment (not the late BTFD surge) German Bunds resumed their crash with European stocks and US equity futures all falling sharply. In fact, as the chart below shows, the Bund rose within 1 basis point of the critical 1.00% level before modestly retracing some of the major losses. The ongoing slide in Bunds has dragged both European peripheral and US Treasurys lower, with the 10Y yield rising as high as 2.42%, the highest since October.

Â

It wasn’t just China that led to the overnight volatility: it was also Greece, whose prime minister rejected Europe’s “best and final” proposal, preserving the hope for a deal in the next few days on terms more agreeable to Athens even though the Troika has made it quite clear such a deal won’t come. As for today’s payment to the IMF, he added “don’t worry.”

In any event, it was once again all about Bund, where SocGen noted moments ago that “Bund buyers are few and far between” adding “even investors who are long-term bulls seem to be short-term bears, with many looking for better levels before stepping in and adding to longs. Many are still very long, which isn’t helping.”

This has been a continuation of the recent sell-off seen in fixed income products over the past month with Bunds down over 1000 ticks from their best levels this year. This move was extended yesterday by comments from ECB’s Draghi who said that there could be more volatility to come and they are willing to look through this. In terms of this morning, German bonds have been subject to a significant bout of CTA selling which has subsequently seen a substantial course of bear-steepening in the German curve.

From an equity stand-point, stocks in Europe are also lower this morning after the DAX opened below its 100DMA and has

continued to drift lower since the open. Additionally, strength seen in the EUR has weighed heavily on German exporters with BMW (-2%) and Daimler (-2.4%) both lower. Furthermore, a lack of progress in discussions between Greece and their European counterparts has also erased some of the optimism heading into discussions, this has also been coupled with some talk doing the round about a dramatic rise in ATM withdrawals in Greece over the past week and comments from the Greek deputy shipping minister who said he could not accept current reform proposals. On a sector specific basis, utilities underperform in the wake of the unfavourable German nuclear tax ruling, while the CAC is the laggard index with losses of 2%.