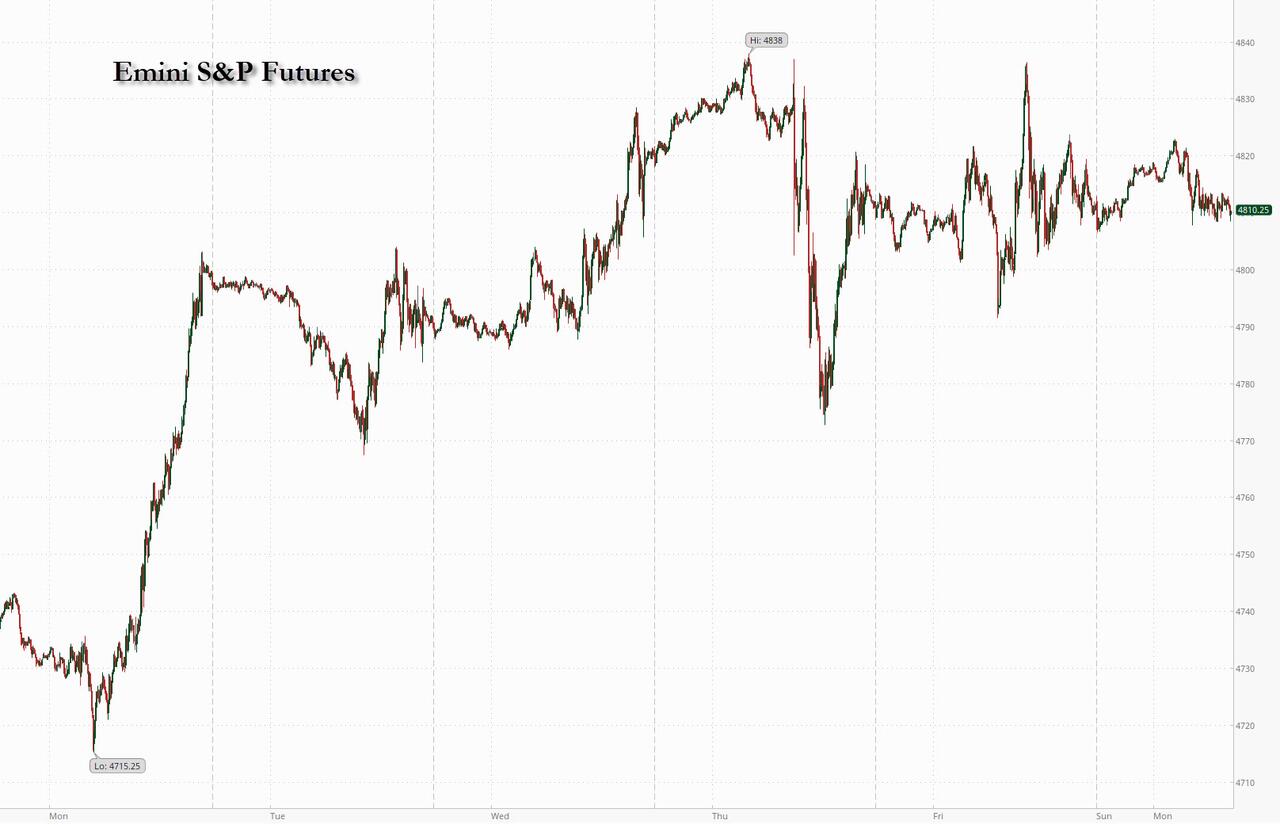

have eased lower but remain above the 1987 trendline at 4772.00 thus far. The Cycle Top is at 4781.82. Being beneath that implies a provisional sell signal. A commonly used focal point may be the diagonal trendline at 4750.00 where the uptrend may be broken.Wednesday’s options chain shows 4780.00 to be a hotly contested Max Investor Pain zone. Long gamma kicks in at 4800.00while short gamma begins at 4760.00. reports, “US equity futures were steady on Monday as investors were displeased by hawkish comments from ECB’s Holzmann , who said there may not be any rate cuts this year which pushed European stocks to session lows, while also bracing for more earnings later this week. With cash stock markets closed for Martin Luther King Jr. Day and global liquidity especially thin, S&P 500 and Nasdaq 100 futures were down about 0.1% and unchanged, respectively, as 8:00 a.m. ET, after both underlying benchmarks gained last week as the earnings season kicked off.”

have eased lower but remain above the 1987 trendline at 4772.00 thus far. The Cycle Top is at 4781.82. Being beneath that implies a provisional sell signal. A commonly used focal point may be the diagonal trendline at 4750.00 where the uptrend may be broken.Wednesday’s options chain shows 4780.00 to be a hotly contested Max Investor Pain zone. Long gamma kicks in at 4800.00while short gamma begins at 4760.00. reports, “US equity futures were steady on Monday as investors were displeased by hawkish comments from ECB’s Holzmann , who said there may not be any rate cuts this year which pushed European stocks to session lows, while also bracing for more earnings later this week. With cash stock markets closed for Martin Luther King Jr. Day and global liquidity especially thin, S&P 500 and Nasdaq 100 futures were down about 0.1% and unchanged, respectively, as 8:00 a.m. ET, after both underlying benchmarks gained last week as the earnings season kicked off.”

are on the rise, making a new high at 13.34. It appears that the Master Cycle low may have been made on Thursday, day 255. Confirmation of that event may be a probe above the 50-day Moving Average is at 13.37. The VIX may be testing that resistance today. Of course, a rise above that may create a buy signal for the VIX.Wednesday’s options chain shows 13.00 offering the Max Pain to options investors. Short gamma resides only at 12.50. Long gamma begins at 14.00 and is well populated to 31.00.More By This Author:SPX Futures: Back To A Flat Position NDX Futures: Relentless MarchNDX Futures Rose

are on the rise, making a new high at 13.34. It appears that the Master Cycle low may have been made on Thursday, day 255. Confirmation of that event may be a probe above the 50-day Moving Average is at 13.37. The VIX may be testing that resistance today. Of course, a rise above that may create a buy signal for the VIX.Wednesday’s options chain shows 13.00 offering the Max Pain to options investors. Short gamma resides only at 12.50. Long gamma begins at 14.00 and is well populated to 31.00.More By This Author:SPX Futures: Back To A Flat Position NDX Futures: Relentless MarchNDX Futures Rose

VIX Futures: On The Rise