(Click on image to enlarge)

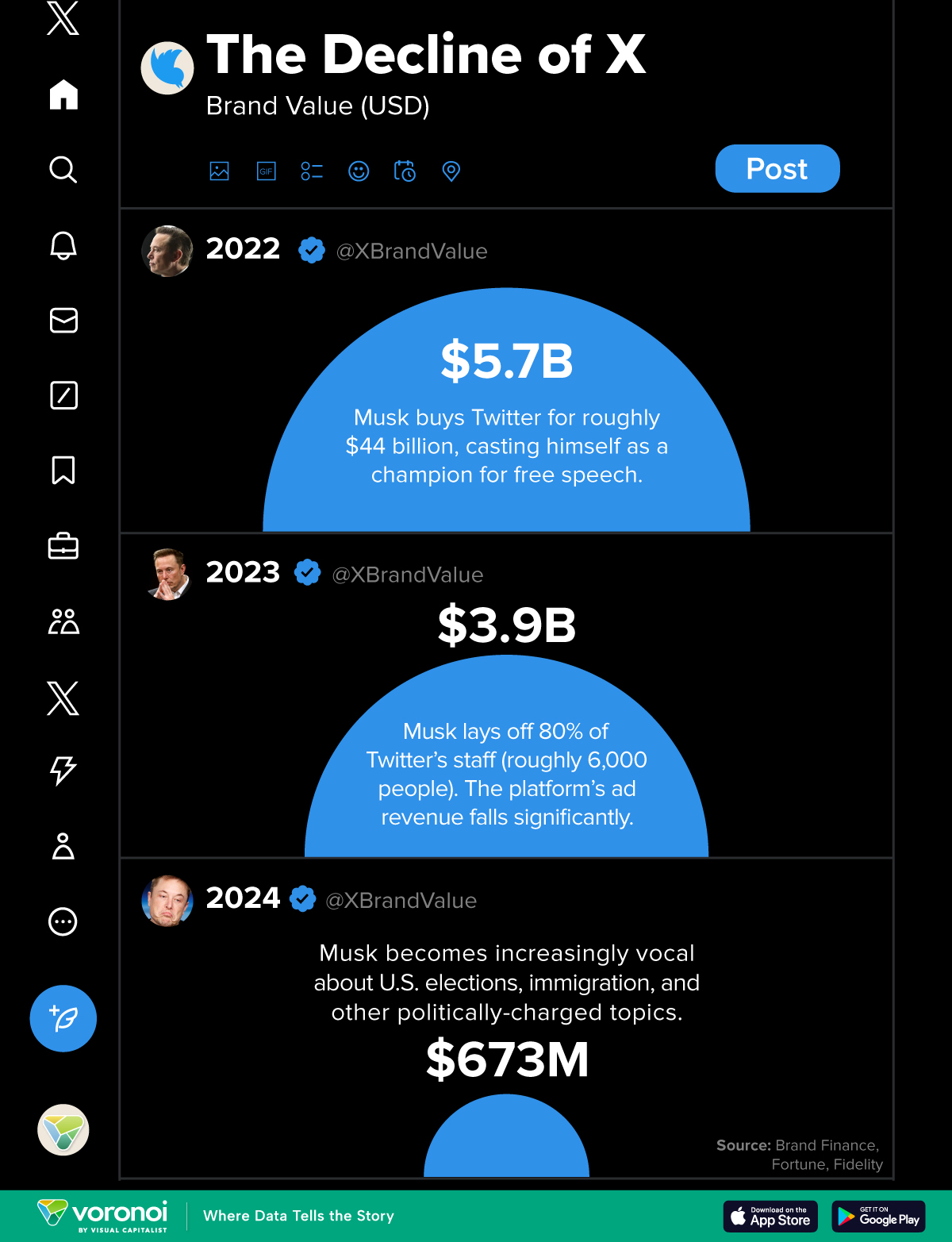

X (formerly Twitter) was acquired by billionaire Elon Musk in 2022 and has since been the subject of ongoing debate.This chart, using data from , illustrates the decline in X’s brand value following Elon Musk’s acquisition in 2022.

Methodology

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach, a brand valuation method compliant with the industry standards set in ISO 10668. This method estimates the likely future revenues attributable to a brand by calculating a royalty rate that would be charged for its use, resulting in a ‘brand value’ defined as the net economic benefit a brand owner would achieve by licensing the brand in the open market.It is important not to confuse brand value with the value of the company as a whole.

Timeline

2022: Musk purchases Twitter for roughly $44 billion.2023: Musk stirs controversy after laying off 80% of Twitter’s staff (approximately 6,000 employees). According to Fortune, the platform’s ad revenue declines significantly.2024: Musk becomes increasingly outspoken on U.S. elections, immigration, and other politically-charged topics.

Brand Decline

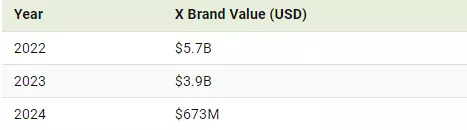

In 2022, Brand Finance valued Twitter at $5.7 billion. By 2023, this dropped to nearly $3.9 billion, and by 2024, the brand’s value had fallen to $673.3 million. According to , X’s ad revenue declined sharply, dropping from over $1 billion per quarter in 2022 to approximately $600 million in 2023.More By This Author:Breaking Down The U.S. Government’s 2024 Fiscal YearSuper Micro, Once The Hottest AI Stock Of 2024, Has CollapsedMapped: Spirits Consumption By U.S. State

According to , X’s ad revenue declined sharply, dropping from over $1 billion per quarter in 2022 to approximately $600 million in 2023.More By This Author:Breaking Down The U.S. Government’s 2024 Fiscal YearSuper Micro, Once The Hottest AI Stock Of 2024, Has CollapsedMapped: Spirits Consumption By U.S. State

Visualizing The Decline In Brand Value Of X (Formerly Twitter)