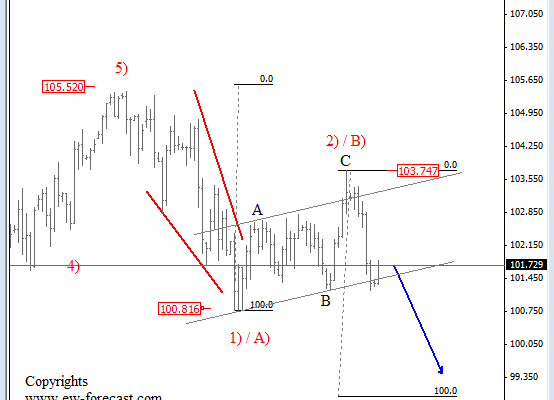

USDJPY has turned bearish last week from 103.74 and lost more than 200 pips, testing the 101.15 swing support. More importantly, the decline is sharp and impulsive on the intraday charts so it seems that a three wave rally from January low is complete and that price is heading down, either in wave C) or wave 3).

Keep in mind that three wave structures, A-B-C move, represent a corrective price action that is fully retraced once completed. As such we expect a decline beneath 100.81 in this week.

From an Elliott Wave perspective, the leg down from 103.74 can be wave C) or 3), but in either case our minimum downside objective is at 99.00 level where current leg would equal to first leg (105.20-100.81.

More: USDJPY forecast.