Data/Event Risks

Data/Event Risks

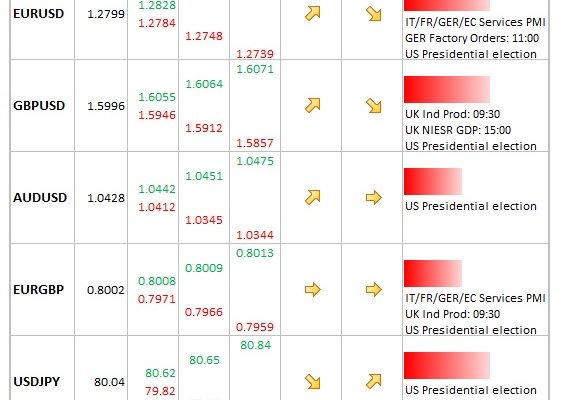

- USD: Latest polls suggest that President Obama will be re-elected today. Results are expected early Wednesday morning (London time).

- EUR: Services PMI data out today from Europe’s economic heavyweights. Weak outcomes relative to expectation will perpetuate the contrast between an improving America and a faltering Europe, in turn weighing on the euro.

- GBP: Industrial production at 09:30, followed by NIESR GDP estimate at 15:00. Recent growth news out of UK has been mildly encouraging – expect GBP to further outperform euro should today’s growth news provide an upside surprise.

Idea of the Day

Traders need to be fleet-footed today. If the services PMI data for Europe is weak, we could well see the euro head lower. However, we could then see some euro shorts cover ahead of a likely Obama victory; the latter would probably weigh on the dollar.

Latest FX News

- USD: The dollar made further forward progress yesterday against most majors, principally on fresh euro fears. Dollar bulls need to be careful – could see some profit-taking ahead of election result.

- EUR: Renewed Spain and Greece concerns hurt the single currency on Monday, but follow-through selling once the euro broke the critical 1.28 level was largely absent. IMF warnings on France and Denmark also weighed on the euro.

- JPY: Partial recovery for the yen yesterday, but looks to be temporary. Yen weakness could well become entrenched before too long – the economy needs a weaker currency.

- AUD: Dollar gains failed to hurt the Aussie at all on Monday, further confirmation that the AUD is still in demand. RBA decision to leave rates unchanged provided AUD with a fresh boost overnight. Aussie remains one of the most favoured major currencies.