Video length: 00:01:24

USD/JPY

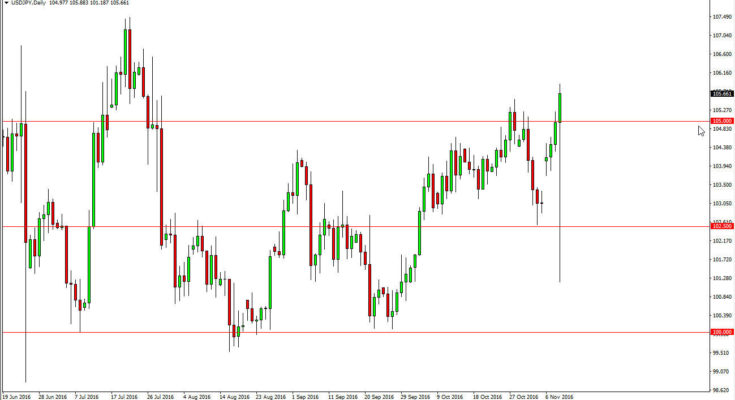

The USD/JPY pair initially fell during the course of the session on Wednesday as the word got out that the presidential election was over, and Donald Trump won. Because of this, the market was caught on the wrong side of the fence, and we fell all the way down to the 101 handle. However, we turn right back around form a massive hammer and we have now broken out to the upside as the US dollar continues to strengthen in general. This looks like a market that is ready to continue reaching towards the 107.50 level, and then above there. Every time we pullback it’s time to start buying, as support should return again and again, and this is probably the most supportive candle that I can imagine at this point, and it looks very likely that the market is going to continue to go higher.

Â

AUD/USD

The Australian dollar initially tried to break out during the day on Wednesday, but the 0.7750 level offered far too much in the way of resistance and because of this it looks like a very negative sign. However, when you look at the totality the market it’s hard not to notice that the lows have been continuing to go higher. A short-term supportive candle is probably the way to go going forward, and you will have to pay attention to the gold markets as they are highly correlated to the Australian dollar and as they go higher, it typically will as well. A break out above the 0.7750 level on a daily closes the signal that I need for more of a “buy-and-hold†type of situation, and that is exactly what I need to see in order to hold onto the position. At this point, and that we will continue to see buying back and forth as the buyers are trying to build up the momentum necessary to move to the 0.80 handle.

Â

Â

​