With signs of China reflation easing, what is the implication for the US dollar?

Here is their view, courtesy of eFXdata:

Bank of America Global Research discusses the implications of China’s reflation outlook on the direction of USD.

“With much of the focus on the US reflation story and its implications for the USD, we have previously argued that investors need to keep an eye on China reflation dynamics. It goes without saying China matters hugely for global growth and especially for countries that are large exporters to China – specifically commodity producers and supply-chain manufacturers,’ BofA notes.

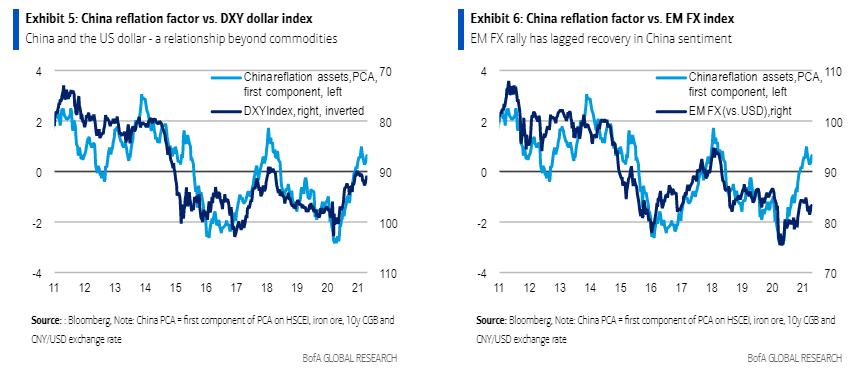

“But there are broader implications for the USD too. Exhibit 5 and Exhibit 6 show our measure of China reflation momentum tends to be associated with a weaker dollar vs. both G10 and EM currencies (and not just commodity FX). Any decline in China reflation optimism would reinforce our bullish USD outlook, which for now is predicated mostly on US economic outperformance and eventual Fed tape,” BofA adds.

By signing up for eFXplus via the link above, you are directly supporting Forex Crunch.